B) False

Correct Answer

verified

Correct Answer

verified

True/False

Dimon Products' sales are expected to be $5 million this year,with 90% on credit and 10% for cash.Sales are expected to grow at a stable,steady rate of 10% annually in the future.Dimon's accounts receivable balance will remain constant at the current level,because the 10% cash sales can be used to support the 10% growth rate,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT directly reflected in the cash budget of a firm that is in the zero tax bracket?

A) Payment lags.

B) Payment for plant construction.

C) Cumulative cash.

D) Repurchases of common stock.

E) Writing off bad debts.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

For a zero-growth firm,it is possible to increase the percentage of sales that are made on credit and still keep accounts receivable at their current level,provided the firm can shorten the length of its collection period sufficiently.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Trade credit can be separated into two components: free trade credit,which is credit received after the discount period ends,and costly trade credit,which is the cost of discounts not taken.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bumpas Enterprises purchases $4,562,500 in goods per year from its sole supplier on terms of 2/15,net 55.If the firm chooses to pay on time but does not take the discount,what is the effective annual percentage cost of its non-free trade credit? (Assume a 365-day year. )

A) 24.49%

B) 20.24%

C) 19.03%

D) 18.62%

E) 17.00%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Margetis Inc.carries an average inventory of $750,000.Its annual sales are $10 million,its cost of goods sold are 75% of annual sales,and its receivables collection period is twice as long as its inventory conversion period.The firm buys on terms of net 30 days,and it pays on time.Its new CFO wants to decrease the cash conversion cycle by 18 days,based on a 365-day year.He believes he can reduce the average inventory to $605,885 with no effect on sales.By how much must the firm also reduce its accounts receivable to meet its goal in the reduction of its cash conversion cycle?

A) $300,997

B) $234,778

C) $249,828

D) $325,077

E) $310,027

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whitmer Inc.sells to customers all over the U.S. ,and all receipts come in to its headquarters in New York City.The firm's average accounts receivable balance is $2.5 million,and they are financed by a bank loan at an 6.75% annual interest rate.The firm is considering setting up a regional lockbox system to speed up collections,and it believes this would reduce receivables by 20%.If the annual cost of the system is $15,000,what pre-tax net annual savings would be realized?

A) $22,313

B) $16,313

C) $18,750

D) $21,375

E) $20,438

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following would tend to reduce the cash conversion cycle?

A) Carry a constant amount of receivables as sales decline.

B) Place larger orders for raw materials to take advantage of price breaks.

C) Take all discounts that are offered.

D) Continue to take all discounts that are offered and pay on the net date.

E) Offer longer payment terms to customers.

G) A) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

A lockbox plan is

A) used to protect cash,i.e. ,to keep it from being stolen.

B) used to identify inventory safety stocks.

C) used to slow down the collection of checks our firm writes.

D) used to speed up the collection of checks received.

E) used primarily by firms where currency is used frequently in transactions,such as fast food restaurants,and less frequently by firms that receive payments as checks.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's collection policy,i.e. ,the procedures it follows to collect accounts receivable,plays an important role in keeping its average collection period short,although too strict a collection policy can reduce profits due to lost sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although short-term interest rates have historically averaged less than long-term rates,the heavy use of short-term debt is considered to be an aggressive current asset financing strategy because of the inherent risks of using short-term financing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Halka Company is a no-growth firm.Its sales fluctuate seasonally,causing total assets to vary from $345,000 to $410,000,but fixed assets remain constant at $260,000.If the firm follows a maturity matching (or moderate) working capital financing policy,what is the most likely total of long-term debt plus equity capital?

A) $345,000

B) $307,050

C) $262,200

D) $369,150

E) $379,500

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm buys on terms of 2/8,net 45 days,it does not take discounts,and it actually pays after 85 days.What is the effective annual percentage cost of its non-free trade credit? (Use a 365-day year. )

A) 10.05%

B) 10.55%

C) 7.84%

D) 8.64%

E) 9.55%

G) B) and C)

Correct Answer

verified

A

Correct Answer

verified

True/False

If a firm sells on terms of 2/10,net 30 days,and its DSO is 28 days,then the fact that the 28-day DSO is less than the 30-day credit period tell us that the credit department is functioning efficiently and there are no past due accounts.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Singal Inc.is preparing its cash budget.It expects to have sales of $30,000 in January,$35,000 in February,and $20,000 in March.If 20% of sales are for cash,40% are credit sales paid in the month after the sale,and another 40% are credit sales paid 2 months after the sale,what are the expected cash receipts for March?

A) $27,600

B) $34,200

C) $30,000

D) $24,600

E) $28,200

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

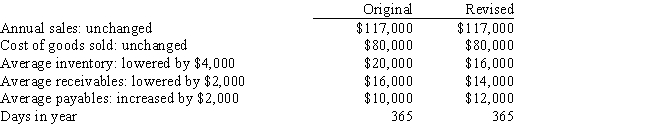

Zervos Inc.had the following data for last year (in millions) .The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4,000, (2) that improvements in the credit department could reduce receivables by $2,000,and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2,000.Furthermore,she thinks that these changes would not affect either sales or the costs of goods sold.If these changes were made,by how many days would the cash conversion cycle be lowered?

A) 40.3 days

B) 37.6 days

C) 39.7 days

D) 33.6 days

E) 32.6 days

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Accruals arise automatically from a firm's operations and are "free" capital in the sense that no explicit interest must normally be paid on accrued liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Net operating working capital,defined as current assets minus the difference between current liabilities and notes payable,is equal to the current ratio minus the quick ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The relative profitability of a firm that employs an aggressive working capital financing policy will improve if the yield curve changes from upward sloping to downward sloping.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 124

Related Exams