A) below-average inventory turnover ratio.

B) low incidence of production schedule disruptions.

C) below-average total assets turnover ratio.

D) relatively high current ratio.

E) relatively low DSO.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When deciding whether or not to take a trade discount,the cost of borrowing from a bank or other source should be compared to the cost of trade credit to determine if the cash discount should be taken.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

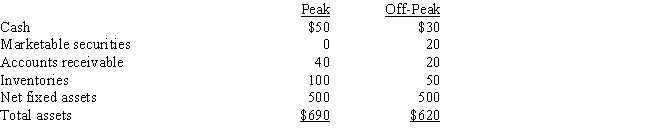

Swim Suits Unlimited is in a highly seasonal business,and the following summary balance sheet data show its assets and liabilities at peak and off-peak seasons (in thousands of dollars) :

From this data we may conclude that

From this data we may conclude that

A) Swim Suits' current asset financing policy calls for exactly matching asset and liability maturities.

B) Swim Suits' current asset financing policy is relatively aggressive;that is,the company finances some of its permanent assets with short-term discretionary debt.

C) Swim Suits follows a relatively conservative approach to current asset financing;that is,some of its short-term needs are met by permanent capital.

D) Without income statement data,we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

E) Without cash flow data,we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following will cause an increase in net working capital?

A) Cash is used to buy marketable securities.

B) A cash dividend is declared and paid.

C) Merchandise is sold at a profit,but the sale is on credit.

D) Long-term bonds are retired with the proceeds of a preferred stock issue.

E) Missing inventory is written off against retained earnings.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The average accounts receivables balance is a function of both the volume of credit sales and the days sales outstanding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zarruk Construction's DSO is 50 days (on a 365-day basis) ,accounts receivable are $100 million,and its balance sheet shows inventory of $170 million.What is the inventory turnover ratio?

A) 4.98

B) 3.86

C) 4.29

D) 5.20

E) 3.22

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company has been offered credit terms of 4/30,net 90 days.What will be the nominal annual percentage cost of its non-free trade credit if it pays 145 days after the purchase? (Assume a 365-day year. )

A) 14.81%

B) 15.74%

C) 13.22%

D) 11.77%

E) 13.89%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A conservative financing approach to working capital will result in permanent current assets and some seasonal current assets being financed using long-term securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm buys on terms of 2/10,net 30,it should pay as early as possible during the discount period to lower its cost of trade credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions would be likely to shorten the cash conversion cycle?

A) Adopt a new manufacturing process that speeds up the conversion of raw materials to finished goods from 20 days to 10 days.

B) Change the credit terms offered to customers from 3/10,net 30 to 1/10,net 50.

C) Begin to take discounts on inventory purchases;we buy on terms of 2/10,net 30.

D) Adopt a new manufacturing process that saves some labor costs but slows down the conversion of raw materials to finished goods from 10 days to 20 days.

E) Change the credit terms offered to customers from 2/10,net 30 to 1/10,net 60.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Accruals are "spontaneous" funds arising automatically from a firm's operations,but unfortunately,due to law and economic forces,firms have little control over the level of these accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buskirk Construction buys on terms of 2/15,net 60 days.It does not take discounts,and it typically pays on time,60 days after the invoice date.Net purchases amount to $500,000 per year.On average,how much "free" trade credit does the firm receive during the year? (Assume a 365-day year,and note that purchases are net of discounts. )

A) $24,863

B) $19,315

C) $16,644

D) $20,548

E) $18,699

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Under normal conditions,a firm's expected ROE would probably be higher if it financed with short-term rather than with long-term debt,but using short-term debt would probably increase the firm's risk.

B) Conservative firms generally use no short-term debt and thus have zero current liabilities.

C) A short-term loan can usually be obtained more quickly than a long-term loan,but the cost of short-term debt is normally higher than that of long-term debt.

D) If a firm that can borrow from its bank at a 6% interest rate buys materials on terms of 2/10,net 30,and if it must pay by Day 30 or else be cut off,then we would expect to see zero accounts payable on its balance sheet.

E) If one of your firm's customers is "stretching" its accounts payable,this may be a nuisance but it will not have an adverse financial impact on your firm if the customer periodically pays off its entire balance.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The three alternative current asset investment policies discussed in the text differ regarding the size of current asset holdings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Helena Furnishings wants to reduce its cash conversion cycle.Which of the following actions should it take?

A) Increases average inventory without increasing sales.

B) Take steps to reduce the DSO.

C) Start paying its bills sooner,which would reduce the average accounts payable but not affect sales.

D) Sell common stock to retire long-term bonds.

E) Sell an issue of long-term bonds and use the proceeds to buy back some of its common stock.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's suppliers stop offering discounts,then its use of trade credit is more likely to increase than to decrease other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

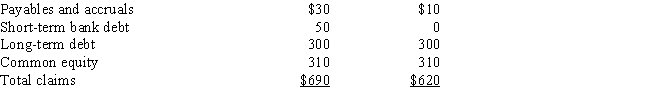

Multiple Choice

Desai Inc.has the following data,in thousands.Assuming a 365-day year,what is the firm's cash conversion cycle? Round to the nearest whole day.

A) 47 days

B) 56 days

C) 52 days

D) 54 days

E) 58 days

G) B) and D)

Correct Answer

verified

Correct Answer

verified

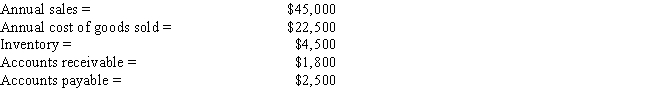

Multiple Choice

Data on Shin Inc for last year are shown below,along with the inventory conversion period (ICP) of the firms against which it benchmarks.The firm's new CFO believes that the company could reduce its inventory enough to reduce its ICP to the benchmarks' average.If this were done,by how much would inventories decline? Use a 365-day year.

A) $12,608

B) $14,752

C) $11,221

D) $11,347

E) $12,482

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kirk Development buys on terms of 2/15,net 60 days.It does not take discounts,and it typically pays on time,60 days after the invoice date.Net purchases amount to $650,000 per year.On average,what is the dollar amount of total trade credit (costly + free) the firm receives during the year,i.e. ,what are its average accounts payable? (Assume a 365-day year,and note that purchases are net of discounts. )

A) $106,849

B) $125,014

C) $117,534

D) $123,945

E) $107,918

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Other things held constant,the higher a firm's days sales outstanding (DSO) ,the better its credit department.

B) If a firm that sells on terms of net 30 changes its policy to 2/10,net 30,and if no change in sales volume occurs,then the firm's DSO will probably increase.

C) If a firm sells on terms of 2/10,net 30,and its DSO is 30 days,then the firm probably has some past due accounts.

D) If a firm sells on terms of net 60,and if its sales are highly seasonal,with a sharp peak in December,then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July.

E) If a firm changed the credit terms offered to its customers from 2/10,net 30 to 2/10,net 60,then its sales should increase,and this should lead to an increase in sales per day,and that should lead to a decrease in the DSO.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 124

Related Exams