A) $-102,000

B) $-129,600

C) $-93,600

D) $-118,800

E) $-120,000

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the optimal capital structure?

A) The optimal capital structure is the mix of debt,equity,and preferred stock that maximizes the company's earnings per share (EPS) .

B) The optimal capital structure is the mix of debt,equity,and preferred stock that maximizes the company's stock price.

C) The optimal capital structure is the mix of debt,equity,and preferred stock that minimizes the company's cost of equity.

D) The optimal capital structure is the mix of debt,equity,and preferred stock that minimizes the company's cost of debt.

E) The optimal capital structure is the mix of debt,equity,and preferred stock that minimizes the company's cost of preferred stock.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

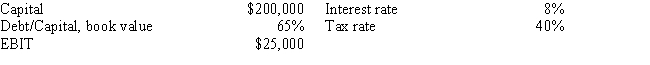

Confu Inc.expects to have the following data during the coming year.What is the firm's expected ROE?

A) 10.51%

B) 14.52%

C) 14.39%

D) 12.51%

E) 12.39%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Miller model begins with the Modigliani and Miller (MM)model without corporate taxes and then adds personal taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm borrows money,it is using financial leverage.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,the lower a firm's tax rate,the more logical it is for the firm to use debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

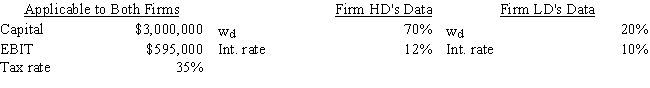

Firms HD and LD are identical except for their use of debt and the interest rates they pay--HD has more debt and thus must pay a higher interest rate.Based on the data given below,how much higher or lower will HD's ROE be versus that of LD,i.e. ,what is ROEHD - ROELD? Do not round your intermediate calculations.

A) 11.31%

B) 13.37%

C) 8.74%

D) 10.28%

E) 10.80%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

According to the signaling theory of capital structure,firms first use common equity for their capital,then use debt if and only if they can raise no more equity on "reasonable" terms.This occurs because the use of debt financing signals to investors that the firm's managers think that the future does not look good.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events is likely to encourage a company to raise its target debt ratio,other things held constant?

A) An increase in the corporate tax rate.

B) An increase in the personal tax rate.

C) An increase in the company's operating leverage.

D) The Federal Reserve tightens interest rates in an effort to fight inflation.

E) The company's stock price hits a new high.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The capital structure that maximizes expected EPS also maximizes the price per share of common stock.

B) The capital structure that minimizes the interest rate on debt also maximizes the expected EPS.

C) The capital structure that minimizes the required return on equity also maximizes the stock price.

D) The capital structure that minimizes the WACC also maximizes the price per share of common stock.

E) The capital structure that gives the firm the best bond rating also maximizes the stock price.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm has $500 million of investor-supplied capital,its return on investors' capital (ROIC) is 15%,and it currently has no debt in its capital structure .The CFO is contemplating a recapitalization where it would issue debt at an after-tax cost of 10% and use the proceeds to buy back some of its common stock,such that the percentage of common equity in the capital structure (wc) is 1 - wd.If the company goes ahead with the recapitalization,its operating income,the size of the firm (i.e. ,total assets) ,total investor-supplied capital,and tax rate would remain unchanged.Which of the following is most likely to occur as a result of the recapitalization?

A) The ROA would increase.

B) The ROA would remain unchanged.

C) The return on investors' capital would decline.

D) The return on investors' capital would increase.

E) The ROE would increase.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If Congress lowered corporate tax rates while other things were held constant,and if the Modigliani-Miller tax-adjusted theory of capital structure were correct,this would tend to cause corporations to decrease their use of debt.

B) A change in the personal tax rate should not affect firms' capital structure decisions.

C) "Business risk" is differentiated from "financial risk" by the fact that financial risk reflects only the use of debt,while business risk reflects both the use of debt and such factors as sales variability,cost variability,and operating leverage.

D) The optimal capital structure is the one that simultaneously (1) maximizes the price of the firm's stock, (2) minimizes its WACC,and (3) maximizes its EPS.

E) If changes in the bankruptcy code made bankruptcy less costly to corporations,this would likely reduce the average corporation's debt ratio.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The graphical probability distribution of ROE for a firm that uses financial leverage would tend to be more peaked than the distribution if the firm used no leverage,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your uncle is considering investing in a new company that will produce high quality stereo speakers.The sales price would be set at 1.70 times the variable cost per unit;the variable cost per unit is estimated to be $75.00;and fixed costs are estimated at $1,170,000.What sales volume would be required to break even,i.e. ,to have EBIT = zero?

A) 23,400

B) 25,851

C) 18,051

D) 17,160

E) 22,286

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

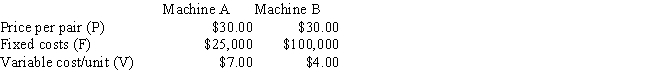

Assume that you and your brother plan to open a business that will make and sell a newly designed type of sandal.Two robotic machines are available to make the sandals,Machine A and Machine B.The price per pair will be $30.00 regardless of which machine is used.The fixed and variable costs associated with the two machines are shown below.What is the difference between the break-even points for Machines A and B? Do not round your intermediate calculations.(Hint: Find BEB - BEA)

A) 3,035

B) 2,235

C) 2,069

D) 2,621

E) 2,759

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

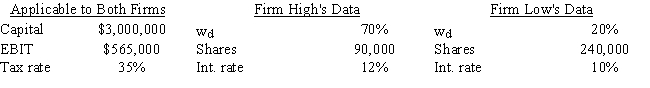

You plan to invest in one of two home delivery pizza companies,High and Low,that were recently founded and are about to commence operations.They are identical except for their use of debt (wd) and the interest rates on their debt--High uses more debt and thus must pay a higher interest rate.Based on the data given below,how much higher or lower will High's expected EPS be versus that of Low,i.e. ,what is EPSHigh - EPSLow? Do not round your intermediate calculations.

A) $01.16

B) $00.67

C) $01.07

D) $00.80

E) $00.89

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Financial risk refers to the extra risk borne by stockholders as a result of a firm's use of debt as compared with their risk if the firm had used no debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since debt financing raises the firm's financial risk,increasing the target debt ratio will always increase the WACC.

B) Since debt financing is cheaper than equity financing,raising a company's debt ratio will always reduce its WACC.

C) Increasing a company's debt ratio will typically reduce the marginal costs of both debt and equity financing.However,this action still may raise the company's WACC.

D) Increasing a company's debt ratio will typically increase the marginal costs of both debt and equity financing.However,this action still may lower the company's WACC.

E) Since a firm's beta coefficient is not affected by its use of financial leverage,leverage does not affect the cost of equity.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

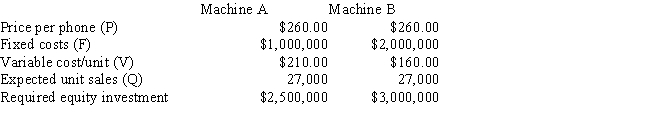

Your company,which is financed entirely with common equity,plans to manufacture a new product,a cell phone that can be worn like a wristwatch.Two robotic machines are available to make the phone,Machine A and Machine B.The price per phone will be $260.00 regardless of which machine is used to make it.The fixed and variable costs associated with the two machines are shown below,along with the capital (all equity) that must be invested to purchase each machine.The expected sales level is 27,000 units.Your company has tax loss carry-forwards that will cause its tax rate to be zero for the life of the project,so T = 0.How much higher or lower will the project's ROE be if you select the machine that produces the higher ROE,i.e. ,what is ROEB - ROEA? (Hint: Since the firm uses no debt and its tax rate is zero,ROE = EBIT/Required investment. )

A) 11.20%

B) 8.87%

C) 7.84%

D) 7.75%

E) 9.33%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If two firms have the same expected earnings per share (EPS)and the same standard deviation of expected EPS,then they must have the same amount of business risk.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 88

Related Exams