B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When calculating the cost of debt,a company needs to adjust for taxes,because interest payments are deductible by the paying corporation.

B) When calculating the cost of preferred stock,companies must adjust for taxes,because dividends paid on preferred stock are deductible by the paying corporation.

C) Because of tax effects,an increase in the risk-free rate will have a greater effect on the after-tax cost of debt than on the cost of common stock as measured by the CAPM.

D) If a company's beta increases,this will increase the cost of equity used to calculate the WACC,but only if the company does not have enough retained earnings to take care of its equity financing and hence must issue new stock.

E) Higher flotation costs reduce investors' expected returns,and that leads to a reduction in a company's WACC.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The CFO of Lenox Industries hired you as a consultant to help estimate its cost of capital.You have obtained the following data: (1) rd = yield on the firm's bonds = 7.00% and the risk premium over its own debt cost = 4.00%.(2) rRF = 5.00%,RPM = 6.00%,and b = 1.50.(3) D1 = $1.20,P0 = $35.00,and g = 8.00% (constant) .You were asked to estimate the cost of equity based on the three most commonly used methods and then to indicate the difference between the highest and lowest of these estimates.What is that difference?

A) 3.00%

B) 3.54%

C) 2.61%

D) 3.72%

E) 2.67%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since the costs of internal and external equity are related,an increase in the flotation cost required to sell a new issue of stock will increase the cost of retained earnings.

B) Since its stockholders are not directly responsible for paying a corporation's income taxes,corporations should focus on before-tax cash flows when calculating the WACC.

C) An increase in a firm's tax rate will increase the component cost of debt,provided the YTM on the firm's bonds is not affected by the change in the tax rate.

D) When the WACC is calculated,it should reflect the costs of new common stock,retained earnings,preferred stock,long-term debt,short-term bank loans if the firm normally finances with bank debt,and accounts payable if the firm normally has accounts payable on its balance sheet.

E) If a firm has been suffering accounting losses that are expected to continue into the foreseeable future,and therefore its tax rate is zero,then it is possible for the after-tax cost of preferred stock to be less than the after-tax cost of debt.

G) B) and C)

Correct Answer

verified

E

Correct Answer

verified

True/False

The cost of perpetual preferred stock is found as the preferred's annual dividend divided by the market price of the preferred stock.No adjustment is needed for taxes because preferred dividends,unlike interest on debt,are not deductible by the issuing firm.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trahan Lumber Company hired you to help estimate its cost of capital.You obtained the following data: D1 = $1.25;P0 = $22.50;g = 5.00% (constant) ;and F = 6.00%.What is the cost of equity raised by selling new common stock?

A) 8.84%

B) 10.91%

C) 11.78%

D) 10.58%

E) 11.35%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The text identifies three methods for estimating the cost of common stock from retained earnings: the CAPM method,the DCF method,and the bond-yield-plus-risk-premium method.Since we cannot be sure that the estimate obtained with any of these methods is correct,it is often appropriate to use all three methods,then consider all three estimates,and end up using a judgmental estimate when calculating the WACC.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scanlon Inc.'s CFO hired you as a consultant to help her estimate the cost of capital.You have been provided with the following data: rRF = 4.10%;RPM = 5.25%;and b = 0.70.Based on the CAPM approach,what is the cost of equity from retained earnings?

A) 9.25%

B) 7.00%

C) 8.47%

D) 7.08%

E) 7.78%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sorensen Systems Inc.is expected to pay a $2.50 dividend at year end (D1 = $2.50) ,the dividend is expected to grow at a constant rate of 5.50% a year,and the common stock currently sells for $37.50 a share.The before-tax cost of debt is 7.50%,and the tax rate is 40%.The target capital structure consists of 45% debt and 55% common equity.What is the company's WACC if all the equity used is from retained earnings? Do not round your intermediate calculations.

A) 9.41%

B) 8.72%

C) 7.58%

D) 9.94%

E) 8.80%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Teall Development Company hired you as a consultant to help them estimate its cost of capital.You have been provided with the following data: D1 = $1.45;P0 = $19.00;and g = 6.50% (constant) .Based on the DCF approach,what is the cost of equity from retained earnings?

A) 10.88%

B) 15.26%

C) 14.41%

D) 13.00%

E) 14.13%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

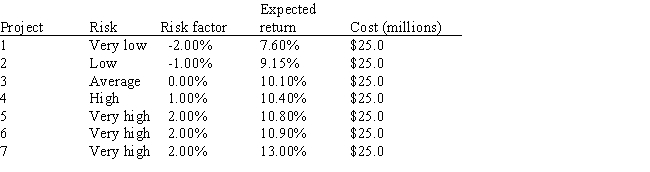

Vang Enterprises,which is debt-free and finances only with equity from retained earnings,is considering 7 equal-sized capital budgeting projects.Its CFO hired you to assist in deciding whether none,some,or all of the projects should be accepted.You have the following information: rRF = 4.50%;RPM = 5.50%;and b = 0.98.The company adds or subtracts a specified percentage to the corporate WACC when it evaluates projects that have above- or below-average risk.Data on the 7 projects are shown below.If these are the only projects under consideration,how large should the capital budget be?

A) $100

B) $125

C) $25

D) $50

E) $75

G) A) and C)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The WACC as used in capital budgeting is an estimate of a company's before-tax cost of capital.

B) The percentage flotation cost associated with issuing new common equity is typically smaller than the flotation cost for new debt.

C) The WACC as used in capital budgeting is an estimate of the cost of all the capital a company has raised to acquire its assets.

D) There is an "opportunity cost" associated with using retained earnings,hence they are not "free."

E) The WACC as used in capital budgeting would be simply the before-tax cost of debt if the firm plans to use only debt to finance its capital budget during the coming year.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Funds acquired by the firm through retaining earnings have no cost because there are no dividend or interest payments associated with them,and no flotation costs are required to raise them,but capital raised by selling new stock or bonds does have a cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The reason why retained earnings have a cost equal to rs is because investors think they can (i.e. ,expect to)earn rs on investments with the same risk as the firm's common stock,and if the firm does not think that it can earn rs on the earnings that it retains,it should pay those earnings out to its investors.Thus,the cost of retained earnings is based on the opportunity cost principle.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost of debt is equal to one minus the marginal tax rate multiplied by the average coupon rate on all outstanding debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

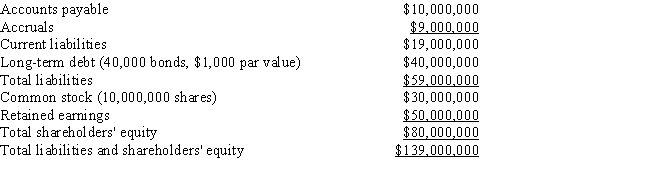

Exhibit 10.1

Assume that you have been hired as a consultant by CGT,a major producer of chemicals and plastics,including plastic grocery bags,styrofoam cups,and fertilizers,to estimate the firm's weighted average cost of capital.The balance sheet and some other information are provided below.

Assets  Liabilities and Equity

Liabilities and Equity  The stock is currently selling for $17.75 per share,and its noncallable $3,319.97 par value,20-year,1.70% bonds with semiannual payments are selling for $881.00.The beta is 1.29,the yield on a 6-month Treasury bill is 3.50%,and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%,but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 10.1.What is the best estimate of the firm's WACC? Do not round your intermediate calculations.

The stock is currently selling for $17.75 per share,and its noncallable $3,319.97 par value,20-year,1.70% bonds with semiannual payments are selling for $881.00.The beta is 1.29,the yield on a 6-month Treasury bill is 3.50%,and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%,but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 10.1.What is the best estimate of the firm's WACC? Do not round your intermediate calculations.

A) 11.26%

B) 11.74%

C) 12.11%

D) 12.59%

E) 12.97%

G) A) and E)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

To help finance a major expansion,Castro Chemical Company sold a noncallable bond several years ago that now has 20 years to maturity.This bond has a 9.25% annual coupon,paid semiannually,sells at a price of $1,025,and has a par value of $1,000.If the firm's tax rate is 40%,what is the component cost of debt for use in the WACC calculation? Do not round your intermediate calculations.

A) 5.93%.

B) 5.93%

C) 5.39%

D) 6.09%

E) 4.69%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of common equity obtained by retaining earnings is the rate of return the marginal stockholder requires on the firm's common stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The MacMillen Company has equal amounts of low-risk,average-risk,and high-risk projects.The firm's overall WACC is 12%.The CFO believes that this is the correct WACC for the company's average-risk projects,but that a lower rate should be used for lower-risk projects and a higher rate for higher-risk projects.The CEO disagrees,on the grounds that even though projects have different risks,the WACC used to evaluate each project should be the same because the company obtains capital for all projects from the same sources.If the CEO's position is accepted,what is likely to happen over time?

A) The company will take on too many high-risk projects and reject too many low-risk projects.

B) The company will take on too many low-risk projects and reject too many high-risk projects.

C) Things will generally even out over time,and,therefore,the firm's risk should remain constant over time.

D) The company's overall WACC should decrease over time because its stock price should be increasing.

E) The CEO's recommendation would maximize the firm's intrinsic value.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

For capital budgeting and cost of capital purposes,the firm should always consider retained earnings as the first source of capital (i.e. ,use these funds first)because retained earnings have no cost to the firm.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 94

Related Exams