A) 30.02%

B) 18.79%

C) 23.43%

D) 27.09%

E) 24.41%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation,recession,and high interest rates are economic events that are best characterized as being

A) systematic risk factors that can be diversified away.

B) company-specific risk factors that can be diversified away.

C) among the factors that are responsible for market risk.

D) risks that are beyond the control of investors and thus should not be considered by security analysts or portfolio managers.

E) irrelevant except to governmental authorities like the Federal Reserve.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Someone who is risk averse has a general dislike for risk and a preference for certainty.If risk aversion exists in the market,then investors in general are willing to accept somewhat lower returns on less risky securities.Different investors have different degrees of risk aversion,and the end result is that investors with greater risk aversion tend to hold securities with lower risk (and therefore a lower expected return)than investors who have more tolerance for risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is the best measure of risk for a single asset held in isolation,and which is the best measure for an asset held in a diversified portfolio?

A) Variance;correlation coefficient.

B) Standard deviation;correlation coefficient.

C) Beta;variance.

D) Coefficient of variation;beta.

E) Beta;beta.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock X has a beta of 0.6,while Stock Y has a beta of 1.4.Which of the following statements is CORRECT?

A) A portfolio consisting of $50,000 invested in Stock X and $50,000 invested in Stock Y will have a required return that exceeds that of the overall market.

B) Stock Y must have a higher expected return and a higher standard deviation than Stock X.

C) If expected inflation increases but the market risk premium is unchanged,then the required return on both stocks will fall by the same amount.

D) If the market risk premium declines but expected inflation is unchanged,the required return on both stocks will decrease,but the decrease will be greater for Stock Y.

E) If expected inflation declines but the market risk premium is unchanged,then the required return on both stocks will decrease but the decrease will be greater for Stock Y.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta = 0.8,while Stock B has a beta = 1.6.Which of the following statements is CORRECT?

A) Stock B's required return is double that of Stock A's.

B) If the marginal investor becomes more risk averse,the required return on Stock B will increase by more than the required return on Stock A.

C) An equally weighted portfolio of Stocks A and B will have a beta lower than 1.2.

D) If the marginal investor becomes more risk averse,the required return on Stock A will increase by more than the required return on Stock B.

E) If the risk-free rate increases but the market risk premium remains constant,the required return on Stock A will increase by more than that on Stock B.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Most corporations earn returns for their stockholders by acquiring and operating tangible and intangible assets.The relevant risk of each asset should be measured in terms of its effect on the risk of the firm's stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The beta of a portfolio of stocks is always smaller than the betas of any of the individual stocks.

B) If you found a stock with a zero historical beta and held it as the only stock in your portfolio,you would by definition have a riskless portfolio.

C) The beta coefficient of a stock is normally found by regressing past returns on a stock against past market returns.One could also construct a scatter diagram of returns on the stock versus those on the market,estimate the slope of the line of best fit,and use it as beta.However,this historical beta may differ from the beta that exists in the future.

D) The beta of a portfolio of stocks is always larger than the betas of any of the individual stocks.

E) It is theoretically possible for a stock to have a beta of 1.0.If a stock did have a beta of 1.0,then,at least in theory,its required rate of return would be equal to the risk-free (default-free) rate of return,rRF.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jill Angel holds a $200,000 portfolio consisting of the following stocks.The portfolio's beta is 0.88.  If Jill replaces Stock A with another stock,E,which has a beta of 1.45,what will the portfolio's new beta be? Do not round your intermediate calculations.

If Jill replaces Stock A with another stock,E,which has a beta of 1.45,what will the portfolio's new beta be? Do not round your intermediate calculations.

A) 1.39

B) 1.28

C) 0.83

D) 1.22

E) 1.11

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kollo Enterprises has a beta of 0.70,the real risk-free rate is 2.00%,investors expect a 3.00% future inflation rate,and the market risk premium is 4.70%.What is Kollo's required rate of return? Do not round your intermediate calculations.

A) 7.96%

B) 7.30%

C) 6.47%

D) 6.96%

E) 8.29%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A graph of the SML as applied to individual stocks would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis.

B) The CAPM has been thoroughly tested,and the theory has been confirmed beyond any reasonable doubt.

C) If two "normal" or "typical" stocks were combined to form a 2-stock portfolio,the portfolio's expected return would be a weighted average of the stocks' expected returns,but the portfolio's standard deviation would probably be greater than the average of the stocks' standard deviations.

D) If investors become more risk averse,then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks.

E) An increase in expected inflation,combined with a constant real risk-free rate and a constant market risk premium,would lead to identical increases in the required returns on a riskless asset and on an average stock,other things held constant.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A large portfolio of randomly selected stocks will always have a standard deviation of returns that is less than the standard deviation of a portfolio with fewer stocks,regardless of how the stocks in the smaller portfolio are selected.

B) Diversifiable risk can be reduced by forming a large portfolio,but normally even highly-diversified portfolios are subject to market (or systematic) risk.

C) A large portfolio of randomly selected stocks will have a standard deviation of returns that is greater than the standard deviation of a 1-stock portfolio if that one stock has a beta less than 1.0.

D) A large portfolio of stocks whose betas are greater than 1.0 will have less market risk than a single stock with a beta = 0.8.

E) If you add enough randomly selected stocks to a portfolio,you can completely eliminate all of the market risk from the portfolio.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the Capital Asset Pricing Model,investors are primarily concerned with portfolio risk,not the risks of individual stocks held in isolation.Thus,the relevant risk of a stock is the stock's contribution to the riskiness of a well-diversified portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

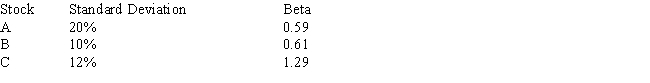

You have the following data on three stocks:  If you are a strict risk minimizer,you would choose Stock ____ if it is to be held in isolation and Stock ____ if it is to be held as part of a well-diversified portfolio.

If you are a strict risk minimizer,you would choose Stock ____ if it is to be held in isolation and Stock ____ if it is to be held as part of a well-diversified portfolio.

A) A;A.

B) A;B.

C) B;A.

D) C;A.

E) C;B.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to occur as you add randomly selected stocks to your portfolio,which currently consists of 3 average stocks?

A) The diversifiable risk of your portfolio will likely decline,but the expected market risk should not change.

B) The expected return of your portfolio is likely to decline.

C) The diversifiable risk will remain the same,but the market risk will likely decline.

D) Both the diversifiable risk and the market risk of your portfolio are likely to decline.

E) The total risk of your portfolio should decline,and as a result,the expected rate of return on the portfolio should also decline.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

"Risk aversion" implies that investors require higher expected returns on riskier than on less risky securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The CAPM is a multi-period model that takes account of differences in securities' maturities,and it can be used to determine the required rate of return for any given level of systematic risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If you plotted the returns of a company against those of the market and found that the slope of your line was negative,the CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor,assuming that the observed relationship is expected to continue in the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the risk-free rate,rRF,increases but the market risk premium, (rM - rRF) ,declines with the net effect being that the overall required return on the market,rM,remains constant.Which of the following statements is CORRECT?

A) The required return of all stocks will increase by the amount of the increase in the risk-free rate.

B) The required return will decline for stocks that have a beta less than 1.0 but will increase for stocks that have a beta greater than 1.0.

C) Since the overall return on the market stays constant,the required return on each individual stock will also remain constant.

D) The required return will increase for stocks that have a beta less than 1.0 but decline for stocks that have a beta greater than 1.0.

E) The required return of all stocks will fall by the amount of the decline in the market risk premium.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The Y-axis intercept of the SML represents the required return of a portfolio with a beta of zero,which is the risk-free rate.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 147

Related Exams