B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

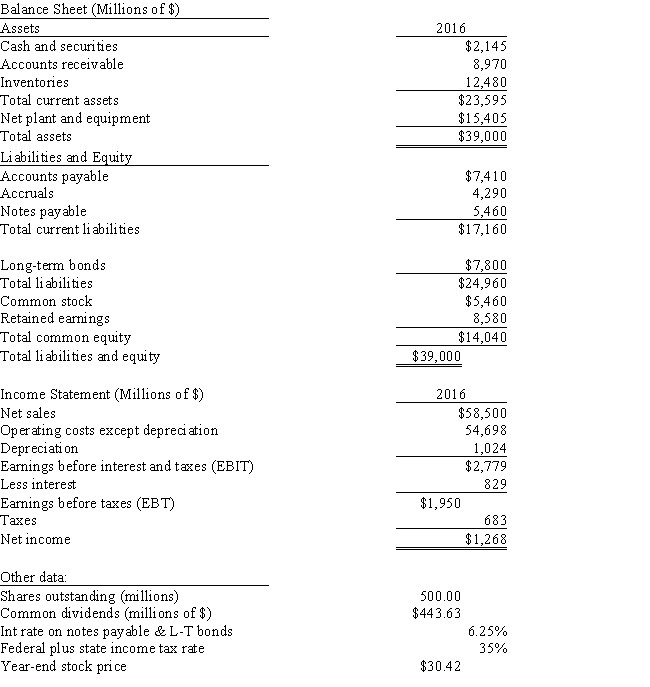

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's BEP? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's BEP? Do not round your intermediate calculations.

A) 5.77%

B) 6.70%

C) 7.13%

D) 6.48%

E) 5.63%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Even though Firm A's current ratio exceeds that of Firm B,Firm B's quick ratio might exceed that of A.However,if A's quick ratio exceeds B's,then we can be certain that A's current ratio is also larger than B's.

B) Suppose a firm wants to maintain a specific TIE ratio.It knows the amount of its debt,the interest rate on that debt,the applicable tax rate,and its operating costs.With this information,the firm can calculate the amount of sales required to achieve its target TIE ratio.

C) Since the ROA measures the firm's effective utilization of assets without considering how these assets are financed,two firms with the same EBIT must have the same ROA.

D) Suppose all firms follow similar financing policies,face similar risks,have equal access to capital,and operate in competitive product and capital markets.However,firms face different operating conditions because,for example,the grocery store industry is different from the airline industry.Under these conditions,firms with high profit margins will tend to have high asset turnover ratios,and firms with low profit margins will tend to have low turnover ratios.

E) Klein Cosmetics has a profit margin of 5.0%,a total assets turnover ratio of 1.5 times,no debt and therefore an equity multiplier of 1.0,and an ROE of 7.5%.The CFO recommends that the firm borrow funds using long-term debt,use the funds to buy back stock,and raise the equity multiplier to 2.0.The size of the firm (assets) would not change.She thinks that operations would not be affected,but interest on the new debt would lower the profit margin to 4.5%.This would probably not be a good move,as it would decrease the ROE from 7.5% to 6.5%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The current and quick ratios help us measure a firm's liquidity.The current ratio measures the relationship of the firm's current assets to its current liabilities,while the quick ratio measures the firm's ability to pay off short-term obligations without relying on the sale of inventories.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Last year Jandik Corp.had $250,000 of assets (which is equal to its total invested capital) ,$18,750 of net income,and a debt-to-total-capital ratio of 37%.Now suppose the new CFO convinces the president to increase the debt-to-total-capital ratio to 48%.Sales,total assets and total invested capital will not be affected,but interest expenses would increase.However,the CFO believes that better cost controls would be sufficient to offset the higher interest expense and thus keep net income unchanged.By how much would the change in the capital structure improve the ROE? Do not round your intermediate calculations.

A) 1.94%

B) 2.07%

C) 2.57%

D) 2.52%

E) 1.96%

G) None of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a security analyst saw that a firm's days' sales outstanding (DSO) was higher than the industry average,and was increasing and trending still higher,this would be interpreted as a sign of strength.

B) A high average DSO indicates that none of its customers are paying on time.In addition,it makes no sense to evaluate the firm's DSO with the firm's credit terms.

C) There is no relationship between the days' sales outstanding (DSO) and the average collection period (ACP) .These ratios measure entirely different things.

D) A reduction in accounts receivable would have no effect on the current ratio,but it would lead to an increase in the quick ratio.

E) If a firm increases its sales while holding its accounts receivable constant,then,other things held constant,its days' sales outstanding will decline.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brookman Inc's latest EPS was $2.75,its book value per share was $22.75,it had 325,000 shares outstanding,and its debt/total invested capital ratio was 44%.The firm finances using only debt and common equity and its total assets equal total invested capital.How much debt was outstanding? Do not round your intermediate calculations.

A) $5,925,563

B) $4,415,125

C) $5,518,906

D) $5,228,438

E) $5,809,375

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

HD Corp and LD Corp have identical assets,sales,interest rates paid on their debt,tax rates,and EBIT.Both firms finance using only debt and common equity and total assets equal total invested capital.However,HD uses more debt than LD.Which of the following statements is CORRECT?

A) Without more information,we cannot tell if HD or LD would have a higher or lower net income.

B) HD would have the lower equity multiplier for use in the DuPont equation.

C) HD would have to pay more in income taxes.

D) HD would have the lower net income as shown on the income statement.

E) HD would have the higher operating margin.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies E and P each reported the same earnings per share (EPS) ,but Company E's stock trades at a higher price.Which of the following statements is CORRECT?

A) Company E probably has fewer growth opportunities.

B) Company E is probably judged by investors to be riskier.

C) Company E must have a higher market-to-book ratio.

D) Company E must pay a lower dividend.

E) Company E trades at a higher P/E ratio.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The inventory turnover and current ratio are related.The combination of a high current ratio and a low inventory turnover ratio,relative to industry norms,suggests that the firm has an above-average inventory level and/or that part of the inventory is obsolete or damaged.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

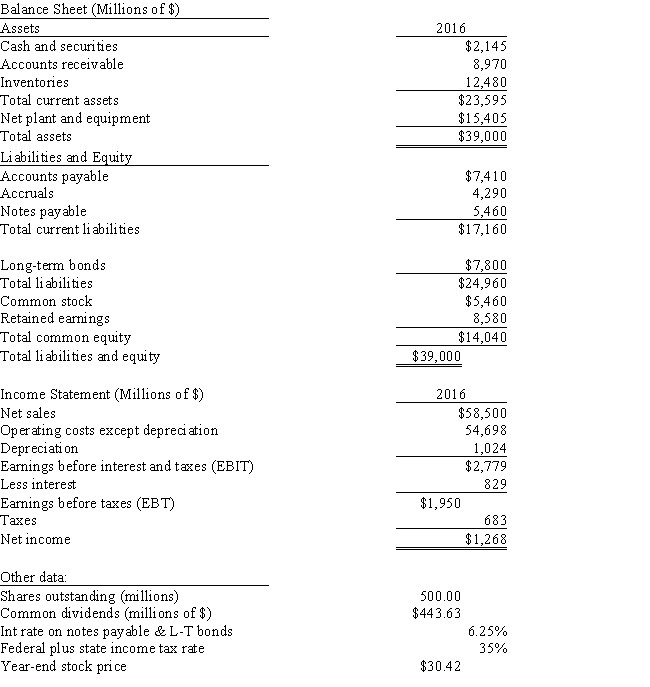

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's total debt to total capital ratio? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's total debt to total capital ratio? Do not round your intermediate calculations.

A) 61.44%

B) 65.28%

C) 49.92%

D) 48.00%

E) 64.00%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The more conservative a firm's management is,the higher its total debt to total capital ratio [measured as (Short-term debt + Long-term debt)/(Debt + Preferred stock + Common equity)] is likely to be.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have the same sales,tax rate,interest rate on their debt,total assets,and basic earning power.Both firms finance using only debt and common equity and total assets equal total invested capital.Both companies have positive net incomes.Company HD has a higher total debt to total capital ratio and,therefore,a higher interest expense.Which of the following statements is CORRECT?

A) Company HD pays less in taxes.

B) Company HD has a lower equity multiplier.

C) Company HD has a higher ROA.

D) Company HD has a higher times-interest-earned (TIE) ratio.

E) Company HD has more net income.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

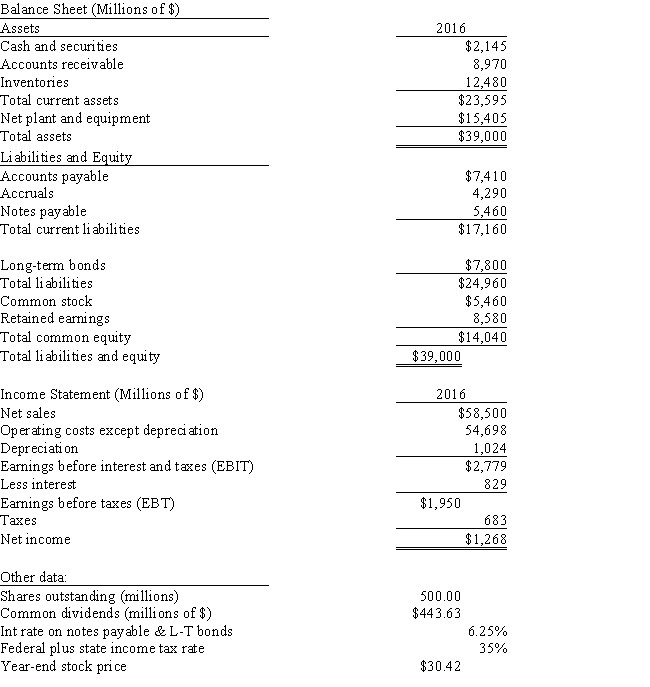

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's total assets turnover? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's total assets turnover? Do not round your intermediate calculations.

A) 1.77

B) 1.29

C) 1.50

D) 1.43

E) 1.19

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,the more debt a firm uses,the lower its profit margin will be.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amram Company's current ratio is 2.0.Considered alone,which of the following actions would lower the current ratio?

A) Borrow using short-term notes payable and use the proceeds to reduce accruals.

B) Borrow using short-term notes payable and use the proceeds to reduce long-term debt.

C) Use cash to reduce accruals.

D) Use cash to reduce short-term notes payable.

E) Use cash to reduce accounts payable.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In general,if investors regard a company as being relatively risky and/or having relatively poor growth prospects,then it will have relatively high P/E and M/B ratios.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The return on common equity (ROE)is generally regarded as being less significant,from a stockholder's viewpoint,than the return on total assets (ROA).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Han Corp's sales last year were $485,000,and its year-end receivables were $52,500.The firm sells on terms that call for customers to pay 30 days after the purchase,but some delay payment beyond Day 30.On average,how many days late do customers pay? Base your answer on this equation: DSO - Allowed credit period = Average days late,and use a 365-day year when calculating the DSO.Assume all sales to be on credit.Do not round your intermediate calculations.

A) 10.18

B) 8.56

C) 8.08

D) 9.51

E) 11.03

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Although a full liquidity analysis requires the use of a cash budget,the current and quick ratios provide fast and easy-to-use estimates of a firm's liquidity position.

B) False

Correct Answer

verified

True

Correct Answer

verified

Showing 1 - 20 of 133

Related Exams