B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Duffert Industries has total assets of $1,080,000 and total current liabilities (consisting only of accounts payable and accruals) of $100,000.Duffert finances using only long-term debt and common equity.The interest rate on its debt is 7% and its tax rate is 40%.The firm's basic earning power ratio is 15% and its debt-to capital rate is 40%.What are Duffert's ROE and ROIC? Do not round your intermediate calculations.

A) 9.33%;8.23%

B) 11.34%;8.53%

C) 13.49%;9.62%

D) 14.35%;9.92%

E) 16.07%;11.01%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

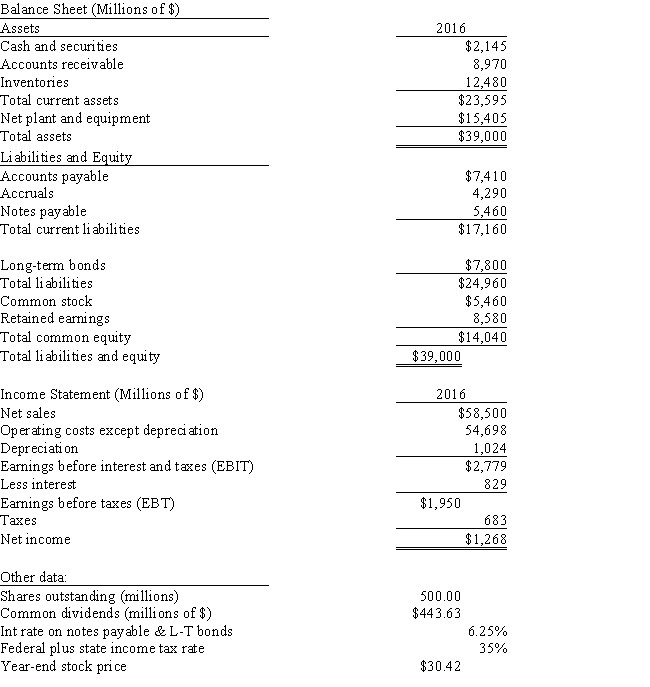

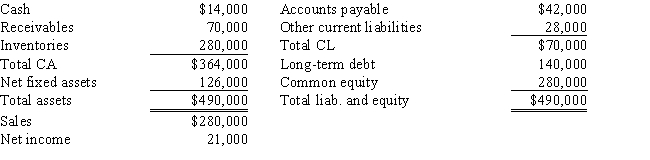

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's current ratio? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's current ratio? Do not round your intermediate calculations.

A) 1.46

B) 1.65

C) 1.58

D) 1.38

E) 1.72

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If Firms X and Y have the same P/E ratios,then their market-to-book ratios must also be equal.

B) If Firms X and Y have the same net income,number of shares outstanding,and price per share,then their P/E ratios must also be the same.

C) If Firms X and Y have the same earnings per share and market-to-book ratio,they must have the same price/earnings ratio.

D) If Firm X's P/E ratio exceeds that of Firm Y,then Y is likely to be less risky and/or be expected to grow at a faster rate.

E) If Firms X and Y have the same net income,number of shares outstanding,and price per share,then their market-to-book ratios must also be the same.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

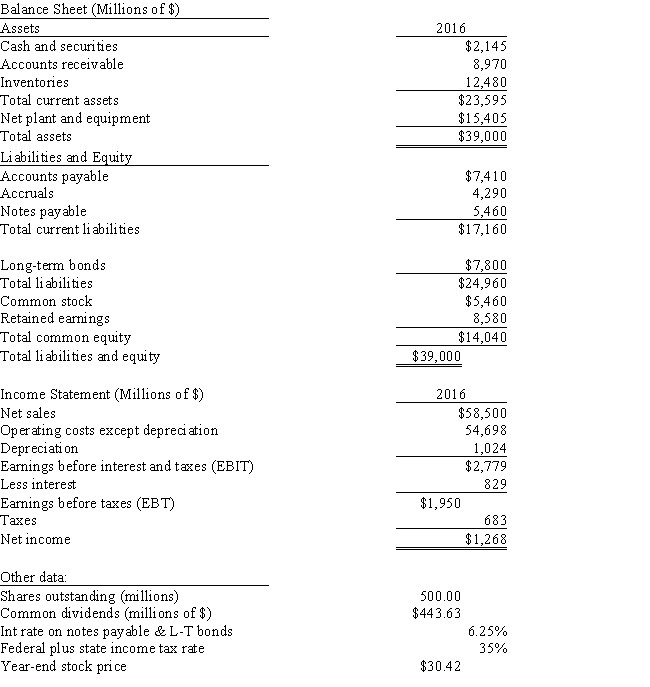

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's quick ratio? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's quick ratio? Do not round your intermediate calculations.

A) 0.58

B) 0.65

C) 0.56

D) 0.81

E) 0.73

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Faldo Corp sells on terms that allow customers 45 days to pay for merchandise.Its sales last year were $325,000,and its year-end receivables were $60,000.If its DSO is less than the 45-day credit period,then customers are paying on time.Otherwise,they are paying late.By how much are customers paying early or late? Base your answer on this equation: DSO - Credit Period = Days early or late,and use a 365-day year when calculating the DSO.A positive answer indicates late payments,while a negative answer indicates early payments.Assume all sales to be on credit.Do not round your intermediate calculations.

A) 18.13

B) 17.01

C) 26.86

D) 22.38

E) 17.46

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

X-1 Corp's total assets at the end of last year were $490,000 and its EBIT was 52,500.What was its basic earning power (BEP) ratio?

A) 13.07%

B) 10.29%

C) 11.57%

D) 12.86%

E) 10.71%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

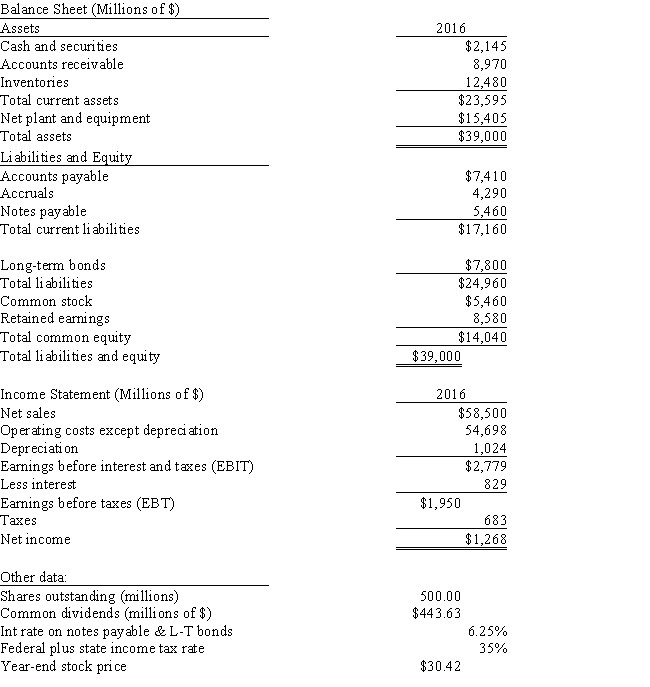

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's book value per share? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's book value per share? Do not round your intermediate calculations.

A) $24.43

B) $28.64

C) $32.85

D) $28.08

E) $27.24

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chang Corp.has $375,000 of assets,and it uses only common equity capital (zero debt) .Its sales for the last year were $520,000,and its net income was $25,000.Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15.0%.What profit margin would the firm need in order to achieve the 15% ROE,holding everything else constant? Do not round your intermediate calculations.

A) 11.03%

B) 8.76%

C) 10.82%

D) 11.14%

E) 12.98%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The inventory turnover ratio and days sales outstanding (DSO)are two ratios that are used to assess how effectively a firm is managing its current assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Profitability ratios show the combined effects of liquidity,asset management,and debt management on a firm's operating results.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The basic earning power ratio (BEP)reflects the earning power of a firm's assets after giving consideration to financial leverage and tax effects.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm sold some inventory on credit as opposed to cash,there is no reason to think that either its current or quick ratio would change.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

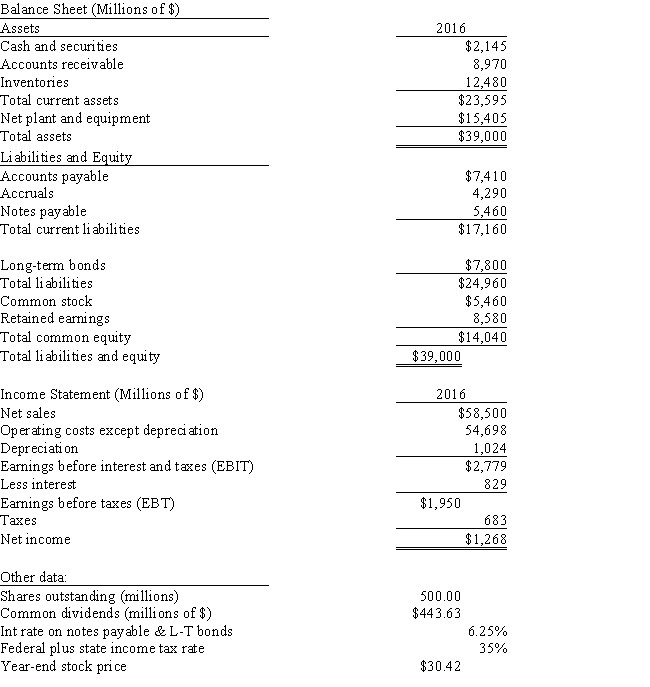

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's ROA? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's ROA? Do not round your intermediate calculations.

A) 3.25%

B) 2.80%

C) 3.38%

D) 4.03%

E) 3.97%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Considered alone,which of the following would increase a company's current ratio?

A) An increase in net fixed assets.

B) An increase in accrued liabilities.

C) An increase in notes payable.

D) An increase in accounts receivable.

E) An increase in accounts payable.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Harrington Inc.had sales of $325,000 and a net income of $19,000,and its year-end assets were $250,000.The firm's total-debt-to-total-capital ratio was 15.0%.The firm finances using only debt and common equity and its total assets equal total invested capital.Based on the DuPont equation,what was the ROE? Do not round your intermediate calculations.

A) 11.09%

B) 8.85%

C) 8.94%

D) 9.03%

E) 7.42%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Other things held constant,the less debt a firm uses,the lower its return on total assets will be.

B) The advantage of the basic earning power ratio (BEP) over the return on total assets for judging a company's operating efficiency is that the BEP does not reflect the effects of debt and taxes.

C) The return on common equity (ROE) is generally regarded as being less significant,from a stockholder's viewpoint,than the return on total assets (ROA) .

D) The price/earnings (P/E) ratio tells us how much investors are willing to pay for a dollar of current earnings.In general,investors regard companies with higher P/E ratios as being more risky and/or less likely to enjoy higher future growth.

E) Suppose you are analyzing two firms in the same industry.Firm A has a profit margin of 10% versus a margin of 8% for Firm B.Firm A's total debt to total capital ratio is 70% versus 20% for Firm B.Based only on these two facts,you cannot reach a conclusion as to which firm is better managed,because the difference in debt,not better management,could be the cause of Firm A's higher profit margin.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Helmuth Inc's latest net income was $1,410,000,and it had 225,000 shares outstanding.The company wants to pay out 45% of its income.What dividend per share should it declare? Do not round your intermediate calculations.

A) $3.13

B) $2.96

C) $2.37

D) $2.45

E) $2.82

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jordan Inc has the following balance sheet and income statement data:  The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.25,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change? Do not round your intermediate calculations.

The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.25,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change? Do not round your intermediate calculations.

A) 16.65%

B) 22.13%

C) 22.55%

D) 21.07%.

E) 21.07%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The ratio of long-term debt to total capital is more likely to experience seasonal fluctuations than is either the DSO or the inventory turnover ratio.

B) If two firms have the same ROA,the firm with the most debt can be expected to have the lower ROE.

C) An increase in the DSO,other things held constant,could be expected to increase the total assets turnover ratio.

D) An increase in the DSO,other things held constant,could be expected to increase the ROE.

E) An increase in a firm's total debt to total capital ratio,with no changes in its sales or operating costs,could be expected to lower its profit margin.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 133

Related Exams