A) $0.99

B) $0.89

C) $0.98

D) $0.91

E) $0.78

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position.Which of the following actions would increase its quick ratio?

A) Offer price reductions along with generous credit terms that would (1) enable the firm to sell some of its excess inventory and (2) lead to an increase in accounts receivable.

B) Issue new common stock and use the proceeds to increase inventories.

C) Speed up the collection of receivables and use the cash generated to increase inventories.

D) Use some of its cash to purchase additional inventories.

E) Issue new common stock and use the proceeds to acquire additional fixed assets.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quigley Inc.is considering two financial plans for the coming year.Management expects sales to be $300,000,operating costs to be $265,000,assets (which is equal to its total invested capital) to be $200,000,and its tax rate to be 35%.Under Plan A it would finance the firm using 25% debt and 75% common equity.The interest rate on the debt would be 8.8%,but under a contract with existing bondholders the TIE ratio would have to be maintained at or above 5.0.Under Plan B,the maximum debt that met the TIE constraint would be employed.Assuming that sales,operating costs,assets,total invested capital,the interest rate,and the tax rate would all remain constant,by how much would the ROE change in response to the change in the capital structure? Do not round your intermediate calculations.

A) 2.31%

B) 1.85%

C) 1.68%

D) 1.52%

E) 2.03%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Rennie Industries had sales of $395,000,assets of $175,000 (which equals total invested capital) ,a profit margin of 5.3%,and an equity multiplier of 1.2.The CFO believes that the company could reduce its assets by $51,000 without affecting either sales or costs.The firm finances using only debt and common equity.Had it reduced its assets by this amount,and had the debt/total invested capital ratio,sales,and costs remained constant,how much would the ROE have changed? Do not round your intermediate calculations.

A) 7.03%

B) 5.25%

C) 6.38%

D) 7.32%

E) 5.90%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose all firms follow similar financing policies,face similar risks,have equal access to capital,and operate in competitive product and capital markets.However,firms face different operating conditions because,for example,the grocery store industry is different from the airline industry.Under these conditions,firms with high profit margins will tend to have high asset turnover ratios,and firms with low profit margins will tend to have low turnover ratios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm has high current and quick ratios,this always indicate that the firm is managing its liquidity position well.

B) If a firm sold some inventory for cash and left the funds in its bank account,its current ratio would probably not change much,but its quick ratio would decline.

C) If a firm sold some inventory on credit,its current ratio would probably not change much,but its quick ratio would decline.

D) If a firm sold some inventory on credit as opposed to cash,there is no reason to think that either its current or quick ratio would change.

E) The inventory turnover ratio and days sales outstanding (DSO) are two ratios that are used to assess how effectively a firm is managing its current assets.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A decline in a firm's inventory turnover ratio suggests that it is improving both its inventory management and its liquidity position,i.e. ,that it is becoming more liquid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Royce Corp's sales last year were $250,000,and its net income was $23,000.What was its profit margin?

A) 9.57%

B) 8.37%

C) 9.20%

D) 11.32%

E) 9.38%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Significant variations in accounting methods among firms make meaningful ratio comparisons between firms more difficult than if all firms used the same or similar accounting methods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

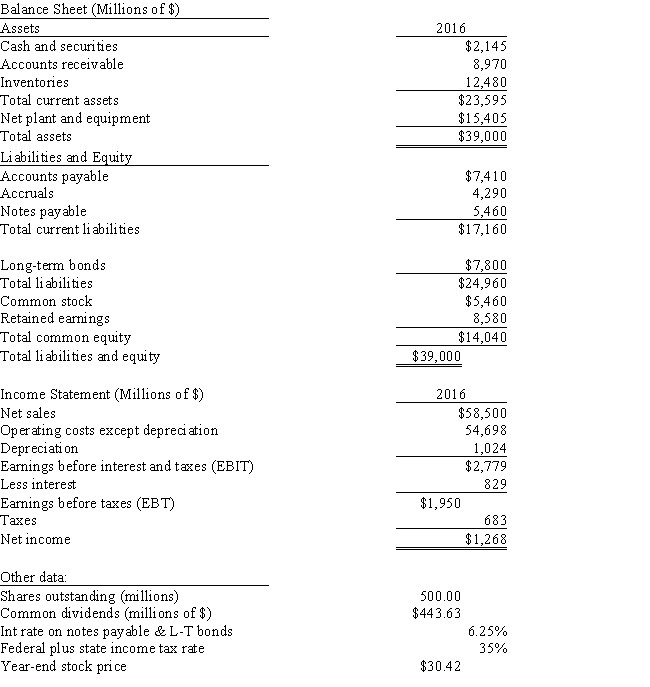

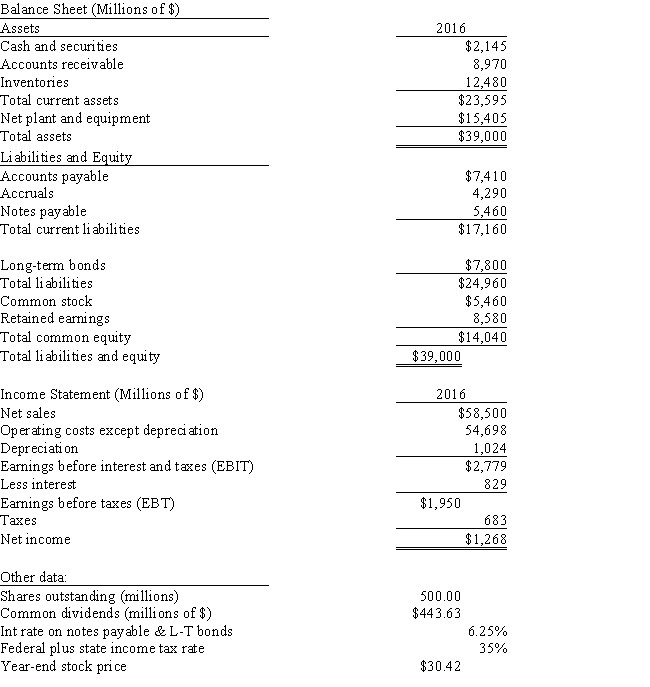

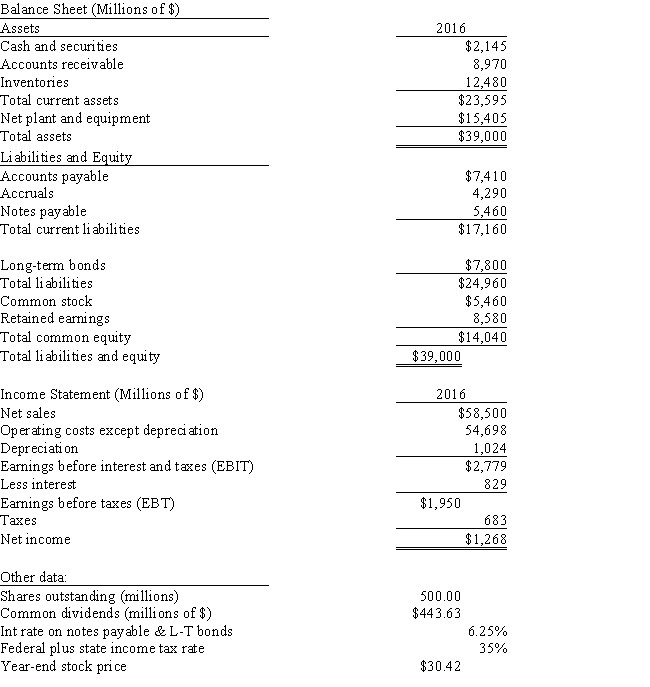

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's TIE? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's TIE? Do not round your intermediate calculations.

A) 3.99

B) 3.19

C) 3.76

D) 3.35

E) 3.82

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A new firm is developing its business plan.It will require $710,000 of assets (which equals total invested capital) ,and it projects $450,000 of sales and $355,000 of operating costs for the first year.Management is reasonably sure of these numbers because of contracts with its customers and suppliers.It can borrow at a rate of 7.5%,but the bank requires it to have a TIE of at least 4.0,and if the TIE falls below this level the bank will call in the loan and the firm will go bankrupt.The firm will use only debt and common equity for financing.What is the maximum debt to capital ratio (measured as debt/total invested capital) the firm can use? (Hint: Find the maximum dollars of interest,then the debt that produces that interest,and then the related debt to capital ratio. ) Do not round your intermediate calculations.

A) 54.86%

B) 46.83%

C) 44.60%

D) 43.26%

E) 38.80%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The return on invested capital (ROIC)differs from the return on assets (ROA).First,ROIC is based on total invested capital rather than total assets.Second,the numerator of the ROIC is after-tax operating income rather than net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Walter Industries' current ratio is 0.5.Considered alone,which of the following actions would increase the company's current ratio?

A) Borrow using short-term notes payable and use the cash to increase inventories.

B) Use cash to reduce accruals.

C) Use cash to reduce accounts payable.

D) Use cash to reduce short-term notes payable.

E) Use cash to reduce long-term bonds outstanding.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's fixed assets turnover ratio is significantly higher than its industry average,this could indicate that it uses its fixed assets very efficiently or is operating at over capacity and should probably add fixed assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's new president wants to strengthen the company's financial position.Which of the following actions would make it financially stronger?

A) Increase accounts receivable while holding sales constant.

B) Increase EBIT while holding sales and assets constant.

C) Increase accounts payable while holding sales constant.

D) Increase notes payable while holding sales constant.

E) Increase inventories while holding sales constant.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's inventory turnover ratio? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's inventory turnover ratio? Do not round your intermediate calculations.

A) 4.69

B) 5.30

C) 5.58

D) 5.77

E) 5.53

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ajax Corp's sales last year were $510,000,its operating costs were $362,500,and its interest charges were $12,500.What was the firm's times-interest-earned (TIE) ratio?

A) 11.80

B) 8.85

C) 13.10

D) 12.15

E) 14.75

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's P/E ratio? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's P/E ratio? Do not round your intermediate calculations.

A) 12.0

B) 12.6

C) 13.2

D) 13.9

E) 14.6

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe that a firm's ROE is above the industry average,but both its profit margin and equity multiplier are below the industry average.Which of the following statements is CORRECT?

A) Its total assets turnover must be above the industry average.

B) Its return on assets must equal the industry average.

C) Its TIE ratio must be below the industry average.

D) Its total assets turnover must be below the industry average.

E) Its total assets turnover must equal the industry average.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9,but at the same time its profit margin rises from 9% to 10%,and its debt increases from 40% of total assets to 60%.The firm finances using only debt and common equity and total assets equal total invested capital.Under these conditions,the ROE will increase.

B) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9,but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%.The firm finances using only debt and common equity and total assets equal total invested capital.Without additional information,we cannot tell what will happen to the ROE.

C) The DuPont equation provides information about how operations affect the ROE,but the equation does not include the effects of debt on the ROE.

D) Other things held constant,an increase in the total debt to total capital ratio will result in an increase in the profit margin.

E) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9,but at the same time its profit margin rises from 9% to 10%,and its debt increases from 40% of total assets to 60%.The firm finances using only debt and common equity and total assets equal total invested capital.Under these conditions,the ROE will decrease.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 133

Related Exams