A) $386.13

B) $601.18

C) $488.77

D) $562.08

E) $537.64

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,a decline in sales accompanied by an increase in financial leverage must result in a lower profit margin.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The profit margin measures net income per dollar of sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

River Corp's total assets at the end of last year were $480,000 and its net income was $32,750.What was its return on total assets?

A) 6.28%

B) 5.73%

C) 6.82%

D) 6.48%

E) 7.71%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ryngard Corp's sales last year were $42,000,and its total assets were $16,000.What was its total assets turnover ratio (TATO) ?

A) 2.68

B) 2.36

C) 2.31

D) 3.15

E) 2.63

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's ROE is equal to 9% and its ROA is equal to 6%,its equity multiplier must be 1.5.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beranek Corp has $695,000 of assets (which equal total invested capital) ,and it uses no debt - it is financed only with common equity.The new CFO wants to employ enough debt to raise the total debt to total capital ratio to 40%,using the proceeds from borrowing to buy back common stock at its book value.How much must the firm borrow to achieve the target debt ratio?

A) $219,620

B) $278,000

C) $344,720

D) $294,680

E) $247,420

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

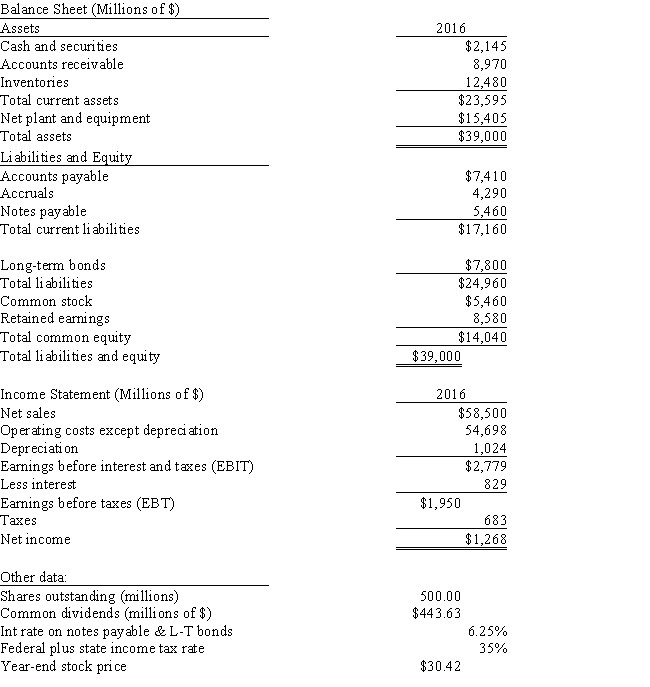

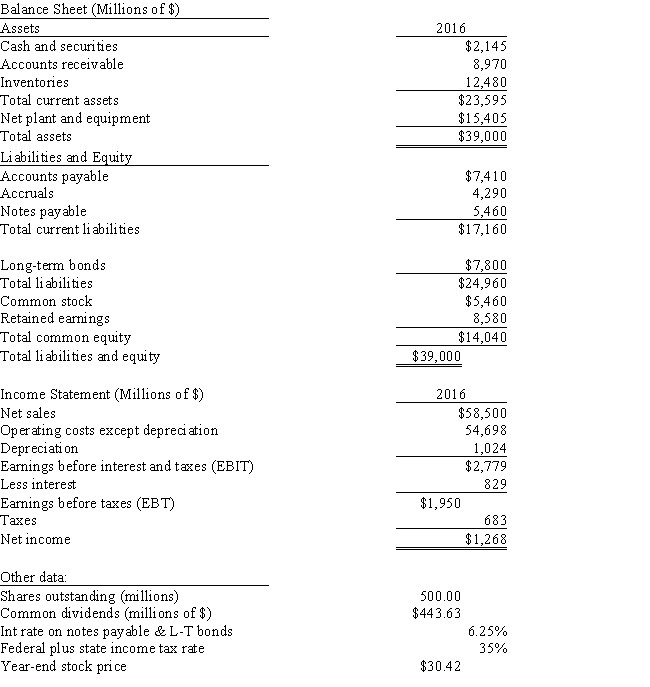

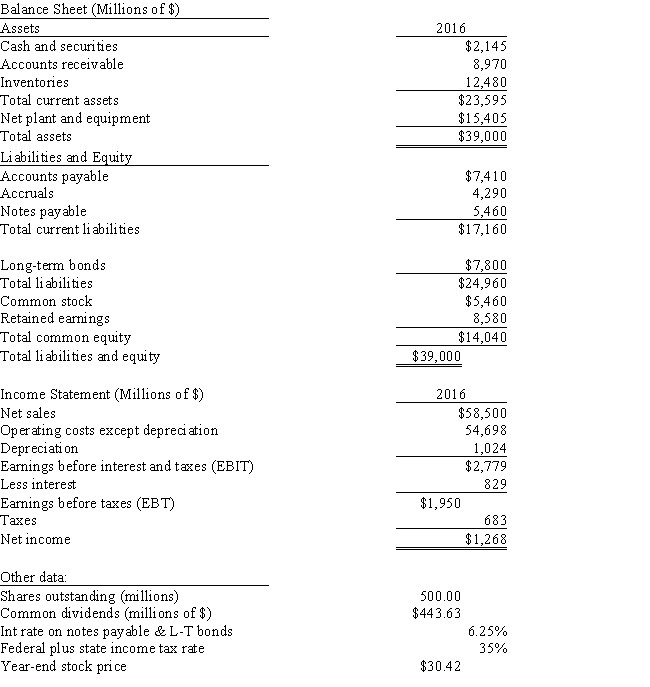

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's days sales outstanding? Assume a 365-day year for this calculation.Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's days sales outstanding? Assume a 365-day year for this calculation.Do not round your intermediate calculations.

A) 47.57

B) 68.84

C) 69.96

D) 50.93

E) 55.97

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Meyer Inc's total invested capital is $660,000,and its total debt outstanding is $185,000.The new CFO wants to establish a total debt to total capital ratio of 55%.The size of the firm will not change.How much debt must the company add or subtract to achieve the target debt to capital ratio?

A) $217,160

B) $178,000

C) $176,220

D) $172,660

E) $138,840

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a bank loan officer were considering a company's loan request,which of the following statements would you consider to be CORRECT?

A) The lower the company's inventory turnover ratio,other things held constant,the lower the interest rate the bank would charge the firm.

B) Other things held constant,the higher the days sales outstanding ratio,the lower the interest rate the bank would charge.

C) Other things held constant,the lower the total debt to total capital ratio,the lower the interest rate the bank would charge.

D) The lower the company's TIE ratio,other things held constant,the lower the interest rate the bank would charge.

E) Other things held constant,the lower the current ratio,the lower the interest rate the bank would charge the firm.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's operating margin? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's operating margin? Do not round your intermediate calculations.

A) 4.23%

B) 4.32%

C) 5.80%

D) 3.80%

E) 4.75%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have the same total assets,sales,operating costs,and tax rates,and they pay the same interest rate on their debt.Both firms finance using only debt and common equity and total assets equal total invested capital.However,company HD has a higher total debt to total capital ratio.Which of the following statements is CORRECT?

A) Given this information,LD must have the higher ROE.

B) Company LD has a higher basic earning power ratio (BEP) .

C) Company HD has a higher basic earning power ratio (BEP) .

D) If the interest rate the companies pay on their debt is more than their basic earning power (BEP) ,then Company HD will have the higher ROE.

E) If the interest rate the companies pay on their debt is less than their basic earning power (BEP) ,then Company HD will have the higher ROE.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Determining whether a firm's financial position is improving or deteriorating requires analyzing more than the ratios for a given year.Trend analysis is one method of examining changes in a firm's performance over time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Casey Communications recently issued new common stock and used the proceeds to pay off some of its short-term notes payable.This action had no effect on the company's total assets or operating income.Which of the following effects would occur as a result of this action?

A) The company's current ratio increased.

B) The company's times interest earned ratio decreased.

C) The company's basic earning power ratio increased.

D) The company's equity multiplier increased.

E) The company's total debt to total capital ratio increased.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hoagland Corp's stock price at the end of last year was $48.50,and its book value per share was $25.00.What was its market/book ratio?

A) 2.17

B) 1.94

C) 1.63

D) 1.55

E) 1.80

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A reduction in inventories would have no effect on the current ratio.

B) An increase in inventories would have no effect on the current ratio.

C) If a firm increases its sales while holding its inventories constant,then,other things held constant,its inventory turnover ratio will increase.

D) A reduction in the inventory turnover ratio will generally lead to an increase in the ROE.

E) If a firm increases its sales while holding its inventories constant,then,other things held constant,its fixed assets turnover ratio will decline.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD are both profitable,and they have the same total assets (TA) ,total invested capital,sales (S) ,return on assets (ROA) ,and profit margin (PM) .Both firms finance using only debt and common equity.However,Company HD has the higher total debt to total capital ratio.Which of the following statements is CORRECT?

A) Company HD has a lower total assets turnover than Company LD.

B) Company HD has a lower equity multiplier than Company LD.

C) Company HD has a higher fixed assets turnover than Company LD.

D) Company HD has a higher ROE than Company LD.

E) Company HD has a lower operating income (EBIT) than Company LD.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Market value ratios provide management with an indication of how investors view the firm's past performance and especially its future prospects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A decline in a firm's inventory turnover ratio suggests that it is improving both its inventory management and its liquidity position,i.e. ,that it is becoming more liquid.

B) In general,it's better to have a low inventory turnover ratio than a high one,as a low one indicates that the firm has an adequate stock of inventory relative to sales and thus will not lose sales as a result of running out of stock.

C) If a firm's fixed assets turnover ratio is significantly lower than its industry average,this could indicate that it uses its fixed assets very efficiently or is operating at over capacity and should probably add fixed assets.

D) The more conservative a firm's management is,the higher its total debt to total capital ratio is likely to be.

E) The days sales outstanding ratio tells us how long it takes,on average,to collect after a sale is made.The DSO can be compared with the firm's credit terms to get an idea of whether customers are paying on time.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.  -Refer to Exhibit 4.1.What is the firm's return on invested capital?

-Refer to Exhibit 4.1.What is the firm's return on invested capital?

A) 4.63%

B) 4.17%

C) 4.35%

D) 5.05%

E) 4.12%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 133

Related Exams