B) False

Correct Answer

verified

Correct Answer

verified

True/False

The fact that long-term debt and common stock are raised infrequently and in large amounts lessens the need for the firm to forecast those accounts on a continual basis.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

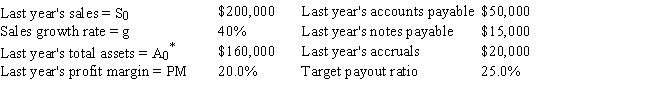

Chua Chang & Wu Inc.is planning its operations for next year,and the CEO wants you to forecast the firm's additional funds needed (AFN) .Data for use in your forecast are shown below.Based on the AFN equation,what is the AFN for the coming year?

A) -$5,400

B) -$7,140

C) -$6,000

D) -$6,720

E) -$6,360

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since accounts payable and accrued liabilities must eventually be paid off,as these accounts increase,AFN as calculated by the AFN equation must also increase.

B) Suppose a firm is operating its fixed assets at below 100% of capacity,but it has no excess current assets.Based on the AFN equation,its AFN will be larger than if it had been operating with excess capacity in both fixed and current assets.

C) If a firm retains all of its earnings,then it cannot require any additional funds to support sales growth.

D) Additional funds needed (AFN) are typically raised using a combination of notes payable,long-term debt,and common stock.Such funds are non-spontaneous in the sense that they require explicit financing decisions to obtain them.

E) If a firm has a positive free cash flow,then it must have either a zero or a negative AFN.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Emery Industries had $450 million of sales and $225 million of fixed assets,so its Fixed Assets/Sales ratio was 50%.However,its fixed assets were used at only 85% of capacity.If the company had been able to sell off enough of its fixed assets at book value so that it was operating at full capacity,with sales held constant at $450 million,how much cash (in millions) would it have generated?

A) $38.14

B) $33.75

C) $30.38

D) $36.79

E) $27.68

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Once a firm has defined its purpose,scope,and objectives,it must develop a strategy or strategies for achieving its goals.The statement of corporate strategies sets forth detailed plans rather than broad approaches for achieving a firm's goals.

B) A firm's corporate purpose states the general philosophy of the business and provides managers with specific operational objectives.

C) Operating plans provide management with detailed implementation guidance,consistent with the corporate strategy,to help meet the corporate objectives.These operating plans can be developed for any time horizon,but many companies use a 5-year horizon.

D) A firm's mission statement defines its lines of business and geographic area of operations.

E) The corporate scope is a condensed version of the entire set of strategic plans.

G) B) and E)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Last year Wei Guan Inc.had $275 million of sales,and it had $270 million of fixed assets that were used at 65% of capacity.In millions,by how much could Wei Guan's sales increase before it is required to increase its fixed assets?

A) $137.71

B) $159.92

C) $115.50

D) $155.48

E) $148.08

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following assumptions is embodied in the AFN equation?

A) All balance sheet accounts are tied directly to sales.

B) Accounts payable and accruals are tied directly to sales.

C) Common stock and long-term debt are tied directly to sales.

D) Fixed assets,but not current assets,are tied directly to sales.

E) Last year's total assets were not optimal for last year's sales.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Two firms with identical capital intensity ratios are generating the same amount of sales.However,Firm A is operating at full capacity,while Firm B is operating below capacity.If the two firms expect the same growth in sales during the next period,then Firm A is likely to need more additional funds than Firm B,other things held constant.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Last year Jain Technologies had $250 million of sales and $100 million of fixed assets,so its Fixed Assets/Sales ratio was 40%.However,its fixed assets were used at only 40% of capacity.Now the company is developing its financial forecast for the coming year.As part of that process,the company wants to set its target Fixed Assets/Sales ratio at the level,it would have had,had it been operating at full capacity.What target Fixed Assets/Sales ratio should the company set?

A) 13.3%

B) 14.1%

C) 16.0%

D) 18.2%

E) 18.4%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Godinho Corp.had $320 million of sales,and it had $75 million of fixed assets that were being operated at 80% of capacity.In millions,how large could sales have been if the company had operated at full capacity?

A) $352.0

B) $392.0

C) $388.0

D) $436.0

E) $400.0

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Handorf-Zhu Inc.had $850 million of sales,and it had $425 million of fixed assets that were used at only 90% of capacity.What is the maximum sales growth rate the company could achieve before it had to increase its fixed assets?

A) 9.00%

B) 13.00%

C) 12.00%

D) 10.33%

E) 11.11%

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The term "spontaneously generated funds" generally refers to increases in the cash account that result from growth in sales,assuming the firm is operating with a positive profit margin.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

To determine the amount of additional funds needed (AFN),you may subtract the expected increase in liabilities,which represents a source of funds,from the sum of the expected increases in retained earnings and assets,both of which are uses of funds.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The first,and most critical,step in constructing a set of forecasted financial statements is the sales forecast.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jefferson City Computers has developed a forecasting model to estimate its AFN for the upcoming year.All else being equal,which of the following factors is most likely to lead to an increase of the additional funds needed (AFN) ?

A) A sharp increase in its forecasted sales.

B) A sharp reduction in its forecasted sales.

C) The company reduces its dividend payout ratio.

D) The company switches its materials purchases to a supplier that sells on terms of 1/5,net 90,from a supplier whose terms are 3/15,net 35.

E) The company discovers that it has excess capacity in its fixed assets.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's capital intensity ratio (A*/S0)decreases as sales increase,use of the AFN formula is likely to understate the amount of additional funds required,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When developing forecasted financial statements there are some inputs that management controls such as the growth rate and operating costs/sales ratio,while other inputs such as the tax rate and interest rate are not under its control.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When we use the AFN equation,we assume that the ratios of assets and liabilities to sales (A0*/S0 and L0*/S0) vary from year to year in a stable,predictable manner.

B) When fixed assets are added in large,discrete units as a company grows,the assumption of constant ratios is more appropriate than if assets are relatively small and can be added in small increments as sales grow.

C) Firms whose fixed assets are "lumpy" frequently have excess capacity,and this should be accounted for in the financial forecasting process.

D) For a firm that uses lumpy assets,it is impossible to have small increases in sales without expanding fixed assets.

E) Regression techniques cannot be used in situations where excess capacity or economies of scale exist.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When we use the AFN equation to forecast the additional funds needed (AFN),we are implicitly assuming that all financial ratios are constant.If financial ratios are not constant,regression techniques can be used to improve the financial forecast.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 39

Related Exams