B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm takes actions that reduce its days sales outstanding (DSO),then,other things held constant,this will lengthen its cash conversion cycle (CCC)and cause a deterioration in its cash position.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a zero-growth firm,it is possible to increase the percentage of sales that are made on credit and still keep accounts receivable at their current level,provided the firm can shorten the length of its collection period sufficiently.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

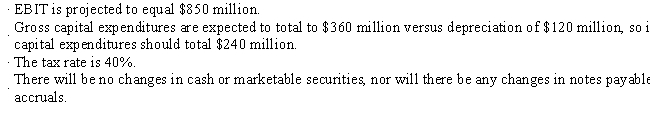

Madura Inc.wants to increase its free cash flow by $180 million during the coming year,which should result in a higher EVA and stock price.The CFO has made these projections for the upcoming year:

What increase in net operating working capital (in millions of dollars) would enable the firm to meet its target increase in FCF?

What increase in net operating working capital (in millions of dollars) would enable the firm to meet its target increase in FCF?

A) $107

B) $90

C) $92

D) $108

E) $75

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When deciding whether or not to take a trade discount,the cost of borrowing from a bank or other source should be compared to the cost of trade credit to determine if the cash discount should be taken.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

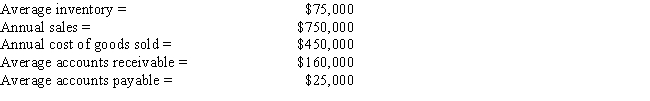

Your consulting firm was recently hired to improve the performance of Shin-Soenen Inc,which is highly profitable but has been experiencing cash shortages due to its high growth rate.As one part of your analysis,you want to determine the firm's cash conversion cycle.Using the following information and a 365-day year,what is the firm's present cash conversion cycle? Do not round intermediate calculations.

A) 136.2 days

B) 103.0 days

C) 122.0 days

D) 118.4 days

E) 104.2 days

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

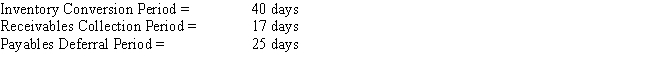

Cass & Company has the following data.What is the firm's cash conversion cycle?

A) 35 days

B) 31 days

C) 25 days

D) 32 days

E) 33 days

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Depreciation is included in the estimate of free cash flows (FCF = EBIT(1 - T) + Depreciation - [Capital expenditures + ΔNOWC]) ,hence depreciation is set forth on a separate line in the cash budget.

B) If cash inflows from collections occur in equal daily amounts but most payments must be made on the 10th of each month,then a regular monthly cash budget will be misleading.The problem can be corrected by using a daily cash budget.

C) Sound working capital policy is designed to maximize the time between cash expenditures on materials and the collection of cash on sales.

D) If a firm wants to generate more cash flow from operations in the next month or two,it could change its credit policy from 2/10,net 30 to net 60.

E) If a firm sells on terms of net 90,and if its sales are highly seasonal,with 80% of its sales in September,then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in October than in August.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The maturity of most bank loans is short term.Bank loans to businesses are frequently made as 90-day notes which are often rolled over,or renewed,rather than repaid when they mature.However,if the borrower's financial situation deteriorates,then the bank may refuse to roll over the loan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT CORRECT?

A) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

B) Accruals are "free" in the sense that no explicit interest is paid on these funds.

C) A conservative approach to working capital management will result in most if not all permanent assets being financed with long-term capital.

D) The risk to a firm that borrows with short-term credit is usually greater than if it borrowed using long-term debt.This added risk stems from the greater variability of interest costs on short-term debt and possible difficulties with rolling over short-term debt.

E) Bank loans generally carry a higher interest rate than commercial paper.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The longer its customers normally hold inventory,the longer the credit period supplier firms normally offer.Still,suppliers have some flexibility in the credit terms they offer.If a supplier lengthens the credit period offered,this will shorten the customer's cash conversion cycle but lengthen the supplier firm's own CCC.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

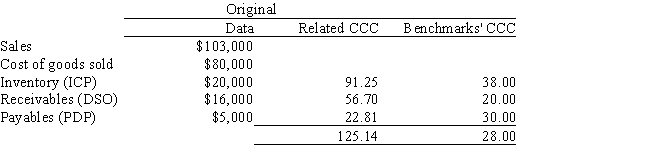

Soenen Inc.had the following data for last year (in millions) .The new CFO believes that the company could improve its working capital management sufficiently to bring its net working capital and cash conversion cycle up to the benchmark companies' level without affecting either sales or the costs of goods sold.Soenen finances its net working capital with a bank loan at an 8% annual interest rate,and it uses a 365-day year.If these changes had been made,by how much would the firm's pre-tax income have increased? Do not round your intermediate calculations.

A) $2,134

B) $1,888

C) $1,454

D) $1,813

E) $1,775

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT directly reflected in the cash budget of a firm that is in the zero tax bracket?

A) Payment lags.

B) Payment for plant construction.

C) Cumulative cash.

D) Repurchases of common stock.

E) Writing off bad debts.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The prime rate charged by big money center banks at any one time is likely to vary greatly (for example,as much as 2 to 4 percentage points)across banks due to banks' ability to differentiate themselves and because different banks operate in different parts of the country.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT directly reflected in the cash budget of a firm that is in the zero tax bracket?

A) Payments lags.

B) Depreciation.

C) Cumulative cash.

D) Repurchases of common stock.

E) Payment for plant construction.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The facts that (1)no explicit interest is paid on accruals and (2)the firm can vary the level of these accounts at will makes them an attractive source of funding to meet the firm's working capital needs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whitmer Inc.sells to customers all over the U.S. ,and all receipts come in to its headquarters in New York City.The firm's average accounts receivable balance is $2.5 million,and they are financed by a bank loan at an 7.50% annual interest rate.The firm is considering setting up a regional lockbox system to speed up collections,and it believes this would reduce receivables by 20%.If the annual cost of the system is $15,000,what pre-tax net annual savings would be realized?

A) $25,650

B) $21,825

C) $22,500

D) $24,300

E) $20,250

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement completions is CORRECT? If the yield curve is upward sloping,then the marketable securities held in a firm's portfolio,assumed to be held for emergencies,should

A) consist mainly of long-term securities because they pay higher rates.

B) consist mainly of short-term securities because they pay higher rates.

C) consist mainly of U.S.Treasury securities to minimize interest rate risk.

D) consist mainly of short-term securities to minimize interest rate risk.

E) be balanced between long- and short-term securities to minimize the adverse effects of either an upward or a downward trend in interest rates.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zarruk Construction's DSO is 50 days (on a 365-day basis) ,accounts receivable are $100 million,and its balance sheet shows inventory of $70 million.What is the inventory turnover ratio?

A) 10.32

B) 8.13

C) 10.43

D) 8.03

E) 11.26

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The concept of permanent current assets reflects the fact that some components of current assets do not shrink to zero even when a business is at its seasonal or cyclical low.Thus,permanent current assets represent a minimum level of current assets that must be financed.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 124

Related Exams