A) $780,000

B) $734,500

C) $650,000

D) $643,500

E) $767,000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Because money has time value,a cash sale is always more profitable than a credit sale.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm has set up a revolving credit agreement with a bank,the risk to the firm of being unable to obtain funds when needed is lower than if it had an informal line of credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm's cost of goods sold (COGS) average $2,000,000 per month,and it keeps inventory equal to 50% of its monthly COGS on hand at all times.Using a 365-day year,what is its inventory conversion period?

A) 15.2 days

B) 15.5 days

C) 13.8 days

D) 16.3 days

E) 12.8 days

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The relative profitability of a firm that employs an aggressive working capital financing policy will improve if the yield curve changes from upward sloping to downward sloping.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Halka Company is a no-growth firm.Its sales fluctuate seasonally,causing total assets to vary from $295,000 to $410,000,but fixed assets remain constant at $260,000.If the firm follows a maturity matching (or moderate) working capital financing policy,what is the most likely total of long-term debt plus equity capital?

A) $295,000

B) $330,400

C) $362,850

D) $227,150

E) $274,350

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT CORRECT?

A) A company may hold a relatively large amount of cash and marketable securities if it is uncertain about its volume of sales,profits,and cash flows during the coming year.

B) Credit policy has an impact on working capital because it influences both sales and the time before receivables are collected.

C) The cash budget is useful to help estimate future financing needs,especially the need for short-term working capital loans.

D) If a firm wants to generate more cash flow from operations in the next month or two,it could change its credit policy from 2/10,net 30 to net 60.

E) Managing working capital is important because it influences financing decisions and the firm's profitability.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Singal Inc.is preparing its cash budget.It expects to have sales of $30,000 in January,$35,000 in February,and $22,500 in March.If 20% of sales are for cash,40% are credit sales paid in the month after the sale,and another 40% are credit sales paid 2 months after the sale,what are the expected cash receipts for March?

A) $31,415

B) $33,855

C) $30,500

D) $26,840

E) $22,875

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The cash conversion cycle (CCC)combines three factors: The inventory conversion period,the receivables collection period,and the payables deferral period,and its purpose is to show how long a firm must finance its working capital.Other things held constant,the shorter the CCC,the more effective the firm's working capital management.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

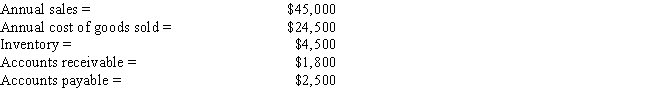

Desai Inc.has the following data,in thousands.Assuming a 365-day year,what is the firm's cash conversion cycle? Do not round intermediate calculations.Round to the nearest whole day.

A) 44 days

B) 40 days

C) 55 days

D) 45 days

E) 54 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Helena Furnishings wants to reduce its cash conversion cycle.Which of the following actions should it take?

A) Increases average inventory without increasing sales.

B) Take steps to reduce the DSO.

C) Start paying its bills sooner,which would reduce the average accounts payable but not affect sales.

D) Sell common stock to retire long-term bonds.

E) Sell an issue of long-term bonds and use the proceeds to buy back some of its common stock.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edwards Enterprises follows a moderate current asset investment policy,but it is now considering a change,perhaps to a restricted or maybe to a relaxed policy.The firm's annual sales are $400,000;its fixed assets are $100,000;its target capital structure calls for 50% debt and 50% equity;its EBIT is $38,000;the interest rate on its debt is 10%;and its tax rate is 40%.With a restricted policy,current assets will be 15% of sales,while under a relaxed policy they will be 25% of sales.What is the difference in the projected ROEs between the restricted and relaxed policies? Do not round intermediate calculations.

A) 4.85%

B) 5.59%

C) 5.70%

D) 6.27%

E) 4.79%

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Accruals arise automatically from a firm's operations and are "free" capital in the sense that no explicit interest must normally be paid on accrued liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Shorter-term cash budgets (such as a daily cash budget for the next month)are generally used for actual cash control while longer-term cash budgets (such as a monthly cash budgets for the next year)are generally used for planning purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gonzales Company currently uses maximum trade credit by not taking discounts on its purchases.The standard industry credit terms offered by all its suppliers are 2/10,net 48 days,and the firm pays on time.The new CFO is considering borrowing from its bank,using short-term notes payable,and then taking discounts.The firm wants to determine the effect of this policy change on its net income.Its net purchases are $11,760 per day,using a 365-day year.The interest rate on the notes payable is 10%,and the tax rate is 40%.If the firm implements the plan,what is the expected change in net income? Do not round intermediate calculations.

A) $25,747

B) $31,927

C) $31,669

D) $22,143

E) $22,915

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

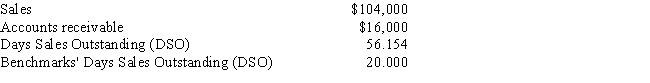

Data on Shick Inc.for last year are shown below,along with the days sales outstanding of the firms against which it benchmarks.The firm's new CFO believes that the company could reduce its receivables enough to reduce its DSO to the benchmarks' average.If this were done,by how much would receivables decline? Use a 365-day year.Do not round your intermediate calculations.

A) $11,538

B) $7,726

C) $12,053

D) $10,301

E) $10,507

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm switched from taking trade credit discounts to paying on the net due date,this might cost the firm some money,but such a policy would probably have only a negligible effect on the income statement and no effect whatever on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is most beneficial to firms that

A) have suppliers who operate in many different parts of the country.

B) have widely dispersed manufacturing facilities.

C) have a large marketable securities portfolio,and cash,to protect.

D) receive payments in the form of currency,such as fast food restaurants,rather than in the form of checks.

E) have customers who operate in many different parts of the country.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A firm's collection policy,i.e. ,the procedures it follows to collect accounts receivable,plays an important role in keeping its average collection period short,although too strict a collection policy can reduce profits due to lost sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm buys on terms of 2/10,net 30,it should pay as early as possible during the discount period to lower its cost of trade credit.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 124

Related Exams