A) A firm can use retained earnings without paying a flotation cost.Therefore,while the cost of retained earnings is not zero,its cost is generally lower than the after-tax cost of debt.

B) The capital structure that minimizes a firm's weighted average cost of capital is also the capital structure that maximizes its stock price.

C) The capital structure that minimizes the firm's weighted average cost of capital is also the capital structure that maximizes its earnings per share.

D) If a firm finds that the cost of debt is less than the cost of equity,increasing its debt ratio must reduce its WACC.

E) Other things held constant,if corporate tax rates declined,then the Modigliani-Miller tax-adjusted theory would suggest that firms should increase their use of debt.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Modigliani and Miller's first article led to the conclusion that capital structure is extremely important,and that every firm has an optimal capital structure that maximizes its value and minimizes its cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's CFO is considering increasing the target debt ratio,which would also increase the company's interest expense.New bonds would be issued and the proceeds would be used to buy back shares of common stock.Neither total assets nor operating income would change,but expected earnings per share (EPS) would increase.Assuming the CFO's estimates are correct,which of the following statements is CORRECT?

A) Since the proposed plan increases the firm's financial risk,the stock price might fall even if EPS increases.

B) If the plan reduces the WACC,the stock price is likely to decline.

C) Since the plan is expected to increase EPS,this implies that net income is also expected to increase.

D) If the plan does increase the EPS,the stock price will automatically increase at the same rate.

E) Under the plan there will be more bonds outstanding,and that will increase their liquidity and thus lower the interest rate on the currently outstanding bonds.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A group of venture investors is considering putting money into Lemma Books,which wants to produce a new reader for electronic books.The variable cost per unit is estimated at $250,the sales price would be set at twice the VC/unit,or $500,and fixed costs are estimated at $600,000.The investors will put up the funds if the project is likely to have an operating income of $500,000 or more.What sales volume would be required in order to meet the minimum profit goal? (Hint: Use the break-even formula,but include the required profit in the numerator. )

A) 3,300

B) 4,400

C) 3,696

D) 5,412

E) 5,104

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) As a rule,the optimal capital structure is found by determining the debt-equity mix that maximizes expected EPS.

B) The optimal capital structure simultaneously maximizes EPS and minimizes the WACC.

C) The optimal capital structure minimizes the cost of equity,which is a necessary condition for maximizing the stock price.

D) The optimal capital structure simultaneously minimizes the cost of debt,the cost of equity,and the WACC.

E) The optimal capital structure simultaneously maximizes the stock price and minimizes the WACC.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,an increase in financial leverage will increase a firm's market (or systematic)risk as measured by its beta coefficient.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Modigliani and Miller (MM)articles implicitly assumed that bankruptcy did not exist.That led to the development of the "trade-off" model,where the firm's value first rises with the use of debt due to the tax shelter of debt,but later falls as more debt is added because the potential costs of bankruptcy begin to more than offset the tax shelter benefits.Under the trade-off theory,an optimal capital structure exists.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

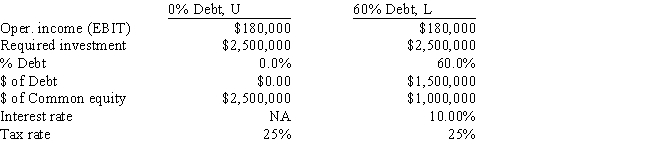

You work for the CEO of a new company that plans to manufacture and sell a new product,a watch that has an embedded TV set and a magnifying glass crystal.The issue now is how to finance the company,with only equity or with a mix of debt and equity.Expected operating income is $180,000.The company is small,so it is not subject to the interest deduction limitation.Other data for the firm are shown below.How much higher or lower will the firm's expected ROE be if it uses some debt rather than all equity,i.e. ,what is ROEL - ROEU? Do not round your intermediate calculations.

A) -3.78%

B) -3.15%

C) -2.84%

D) -4.10%

E) -3.31%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

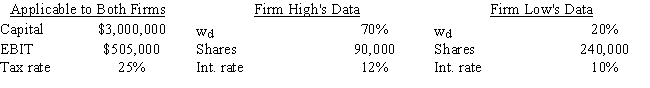

You plan to invest in one of two home delivery pizza companies,High and Low,that were recently founded and are about to commence operations.They are identical except for their use of debt (wd) and the interest rates on their debt--High uses more debt and thus must pay a higher interest rate.Both companies are small,so they are not subject to the interest deduction limitation.Based on the data given below,how much higher or lower will High's expected EPS be versus that of Low,i.e. ,what is EPSHigh - EPSLow? Do not round your intermediate calculations.

A) $0.90

B) $0.57

C) $0.54

D) $0.75

E) $0.72

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since debt financing raises the firm's financial risk,increasing the target debt ratio will always increase the WACC.

B) Since debt financing is cheaper than equity financing,raising a company's debt ratio will always reduce its WACC.

C) Increasing a company's debt ratio will typically reduce the marginal costs of both debt and equity financing.However,this action still may raise the company's WACC.

D) Increasing a company's debt ratio will typically increase the marginal costs of both debt and equity financing.However,this action still may lower the company's WACC.

E) Since a firm's beta coefficient is not affected by its use of financial leverage,leverage does not affect the cost of equity.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southwest U's campus book store sells course packs for $14 each.The variable cost per pack is $12,and at current annual sales of 49,000 packs,the store earns $75,000 before taxes on course packs.How much are the fixed costs of producing the course packs?

A) $25,300

B) $18,860

C) $27,140

D) $23,000

E) $27,600

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

According to the signaling theory of capital structure,firms first use common equity for their capital,then use debt if and only if they can raise no more equity on "reasonable" terms.This occurs because the use of debt financing signals to investors that the firm's managers think that the future does not look good.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

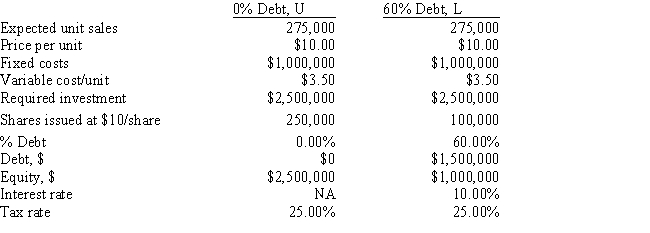

Your girlfriend plans to start a new company to make a new type of cat litter.Her father will finance the operation,but she will have to pay him back.You are helping her,and the issue now is how to finance the company,with equity only or with a mix of debt and equity.The price per unit will be $10.00 regardless of how the firm is financed.The expected fixed and variable operating costs,along with other information,are shown below.How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity,i.e. ,what is EPSL - EPSU? Do not round your intermediate calculations.

A) $2.42

B) $2.78

C) $1.94

D) $2.18

E) $2.06

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Modigliani and Miller (MM),in their second article,took account of taxes,bankruptcy,and other factors that were assumed away in their original article.Once they took account of all these assumptions,they concluded that every firm has a unique optimal capital structure.Moreover,a manager can use the second MM model to determine his or her firm's optimal debt ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's treasurer likes to be in a position to raise funds to support operations whenever such funds are needed,even in "bad times".This is called "financial flexibility," and the lower the firm's debt ratio,the greater its financial flexibility,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The graphical probability distribution of ROE for a firm that uses financial leverage would tend to be more peaked than the distribution if the firm used no leverage,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When a company increases its debt ratio,the costs of equity and debt both increase.Therefore,the WACC must also increase.

B) The capital structure that maximizes the stock price is generally the capital structure that also maximizes earnings per share.

C) All else equal,an increase in the corporate tax rate would tend to encourage companies to increase their debt ratios.

D) Since debt financing raises the firm's financial risk,increasing a company's debt ratio will always increase its WACC.

E) Since the cost of debt is generally fixed,increasing the debt ratio tends to stabilize net income.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your uncle is considering investing in a new company that will produce high quality stereo speakers.The sales price would be set at 1.50 times the variable cost per unit;the variable cost per unit is estimated to be $75.00;and fixed costs are estimated at $1,120,000.What sales volume would be required to break even,i.e. ,to have EBIT = zero?

A) 32,853

B) 28,075

C) 28,373

D) 33,152

E) 29,867

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,firms that use assets that can be sold easily (like trucks)tend to use more debt than firms whose assets are harder to sell (like those engaged in research and development).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm borrows money,it is using financial leverage.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 88

Related Exams