A) Preferred stockholders have a priority over bondholders to the income in the event of a bankruptcy,but not to the proceeds in the event of a liquidation.

B) The preferred stock of a given firm is generally less risky to investors than the same firm's common stock.

C) Corporations cannot buy the preferred stocks of other corporations.

D) Preferred dividends are not generally cumulative.

E) A big advantage of preferred stock is that dividends on preferred stocks are tax deductible by the issuing corporation.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D0 = $2.25,g (which is constant) = 3.5%,and P0 = $52,then what is the stock's expected dividend yield for the coming year?

A) 3.36%

B) 3.81%

C) 4.61%

D) 4.48%

E) 4.25%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D1 = $1.50,g (which is constant) = 2.5%,and P0 = $56,then what is the stock's expected capital gains yield for the coming year?

A) 3.08%

B) 1.95%

C) 2.98%

D) 2.50%

E) 2.83%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Boyson Corporation's projected free cash flow for next year is FCF1 = $250,000,and FCF is expected to grow at a constant rate of 6.5%.Assume the firm has zero non-operating assets.If the company's weighted average cost of capital is 11.5%,then what is the firm's total corporate value?

A) $3,850,000

B) $4,000,000

C) $5,000,000

D) $5,050,000

E) $4,200,000

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Molen Inc.has an outstanding issue of perpetual preferred stock with an annual dividend of $4.00 per share.If the required return on this preferred stock is 6.5%,then at what price should the stock sell?

A) $61.54

B) $64.62

C) $48.00

D) $52.92

E) $63.38

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Savickas Petroleum's stock has a required return of 12.00%,and the stock sells for $44.00 per share.The firm just paid a dividend of $1.00,and the dividend is expected to grow by 30.00% per year for the next 4 years,so D4 = $1.00(1.30) 4 = $2.8561.After t = 4,the dividend is expected to grow at a constant rate of X% per year forever.What is the stock's expected constant growth rate after t = 4,i.e. ,what is X? Do not round your intermediate calculations.

A) 6.91%

B) 8.01%

C) 7.05%

D) 5.60%

E) 5.73%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock is a hybrid-a cross between a common stock and a bond-in the sense that it pays dividends that normally increase annually (like a stock),but its payments are contractually guaranteed (like interest on a bond).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gupta Corporation is undergoing a restructuring,and its free cash flows are expected to vary considerably during the next few years.However,the FCF is expected to be $25.00 million in Year 5,and the FCF growth rate is expected to be a constant 6.5% beyond that point.The weighted average cost of capital is 12.0%.What is the horizon (or continuing) value (in millions) at t = 5?

A) $387

B) $421

C) $562

D) $484

E) $402

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rebello's preferred stock pays a dividend of $1.00 per quarter,and it sells for $57.50 per share.What is its effective annual (not nominal) rate of return?

A) 6.78%

B) 8.07%

C) 7.28%

D) 8.14%

E) 7.14%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mooradian Corporation's free cash flow during the just-ended year (t = 0) was $160 million,and its FCF is expected to grow at a constant rate of 5.0% in the future.Assume the firm has zero non-operating assets.If the weighted average cost of capital is 12.5%,what is the firm's total corporate value,in millions?

A) $2,240

B) $2,374

C) $2,710

D) $2,016

E) $2,778

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Huang Company's last dividend was $1.25.The dividend growth rate is expected to be constant at 15.0% for 3 years,after which dividends are expected to grow at a rate of 6% forever.If the firm's required return (rs) is 11%,what is its current stock price? Do not round intermediate calculations.

A) $31.49

B) $39.53

C) $26.80

D) $33.50

E) $34.17

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT,assuming stocks are in equilibrium?

A) The dividend yield on a constant growth stock must equal its expected total return minus its expected capital gains yield.

B) Assume that the required return on a given stock is 13%.If the stock's dividend is growing at a constant rate of 5%,then its expected dividend yield is 5% as well.

C) A stock's dividend yield can never exceed its expected growth rate.

D) A required condition for one to use the constant growth model is that the stock's expected growth rate exceed its required rate of return.

E) Other things held constant,the higher a company's beta coefficient,the lower its required rate of return.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a stock's expected return as seen by the marginal investor exceeds his or her required return,then the investor will buy the stock until its price has risen enough to bring the expected return down to equal the required return.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

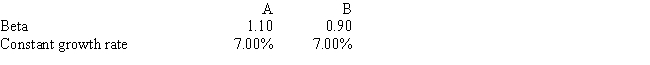

Stocks A and B have the following data.The market risk premium is 6.0% and the risk-free rate is 6.4%.Assuming the stock market is efficient and the stocks are in equilibrium,which of the following statements is CORRECT?

A) Stock A must have a higher stock price than Stock B.

B) Stock A must have a higher dividend yield than Stock B.

C) Stock B's dividend yield equals its expected dividend growth rate.

D) Stock B must have the higher required return.

E) Stock B could have the higher expected return.

G) B) and C)

Correct Answer

verified

B

Correct Answer

verified

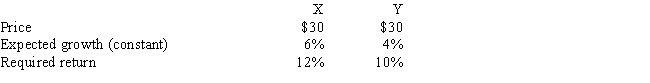

Multiple Choice

Stocks X and Y have the following data.Assuming the stock market is efficient and the stocks are in equilibrium,which of the following statements is CORRECT?

A) Stock X has a higher dividend yield than Stock Y.

B) Stock Y has a higher dividend yield than Stock X.

C) One year from now,Stock X's price is expected to be higher than Stock Y's price.

D) Stock X has the higher expected year-end dividend.

E) Stock Y has a higher capital gains yield.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

From an investor's perspective,a firm's preferred stock is generally considered to be less risky than its common stock but more risky than its bonds.However,from a corporate issuer's standpoint,these risk relationships are reversed: bonds are the most risky for the firm,preferred is next,and common is least risky.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cash flows associated with common stock are more difficult to estimate than those related to bonds because stock has a residual claim against the company versus a contractual obligation for a bond.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a stock's dividend is expected to grow at a constant rate of 5% a year,then which of the following statements is CORRECT? The stock is in equilibrium.

A) The expected return on the stock is 5% a year.

B) The stock's dividend yield is 5%.

C) The price of the stock is expected to decline in the future.

D) The stock's required return must be equal to or less than 5%.

E) The stock's price one year from now is expected to be 5% above the current price.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If markets are in equilibrium,which of the following conditions will exist?

A) Each stock's expected return should equal its realized return as seen by the marginal investor.

B) Each stock's expected return should equal its required return as seen by the marginal investor.

C) All stocks should have the same expected return as seen by the marginal investor.

D) The expected and required returns on stocks and bonds should be equal.

E) All stocks should have the same realized return during the coming year.

G) A) and B)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Carter's preferred stock pays a dividend of $1.00 per quarter.If the price of the stock is $70.00,what is its nominal (not effective) annual rate of return?

A) 4.29%

B) 6.57%

C) 6.74%

D) 4.86%

E) 5.71%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 89

Related Exams