A) If expected inflation remains constant but the market risk premium (rM - rRF) declines,the required return of Stock LB will decline but the required return of Stock HB will increase.

B) If both expected inflation and the market risk premium (rM - rRF) increase,the required return on Stock HB will increase by more than that on Stock LB.

C) If both expected inflation and the market risk premium (rM - rRF) increase,the required returns of both stocks will increase by the same amount.

D) Since the market is in equilibrium,the required returns of the two stocks should be the same.

E) If expected inflation remains constant but the market risk premium (rM - rRF) declines,the required return of Stock HB will decline but the required return of Stock LB will increase.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.8,Stock B has a beta of 1.0,and Stock C has a beta of 1.2.Portfolio P has 1/3 of its value invested in each stock.Each stock has a standard deviation of 25%,and their returns are independent of one another,i.e. ,the correlation coefficients between each pair of stocks is zero.Assuming the market is in equilibrium,which of the following statements is CORRECT?

A) Portfolio P's expected return is greater than the expected return on Stock B.

B) Portfolio P's expected return is equal to the expected return on Stock A.

C) Portfolio P's expected return is less than the expected return on Stock B.

D) Portfolio P's expected return is equal to the expected return on Stock B.

E) Portfolio P's expected return is greater than the expected return on Stock C.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jill Angel holds a $200,000 portfolio consisting of the following stocks.The portfolio's beta is 0.88. If Jill replaces Stock A with another stock,E,which has a beta of 1.30,what will the portfolio's new beta be? Do not round your intermediate calculations.

A) 1.40

B) 0.97

C) 0.91

D) 1.24

E) 1.08

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 1.2 and a standard deviation of 20%.Stock B has a beta of 0.8 and a standard deviation of 25%.Portfolio P has $200,000 consisting of $100,000 invested in Stock A and $100,000 in Stock B.Which of the following statements is CORRECT? (Assume that the stocks are in equilibrium. )

A) Stock A's returns are less highly correlated with the returns on most other stocks than are B's returns.

B) Stock B has a higher required rate of return than Stock A.

C) Portfolio P has a standard deviation of 22.5%.

D) More information is needed to determine the portfolio's beta.

E) Portfolio P has a beta of 1.0.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Collections Inc.is in the business of collecting past-due accounts for other companies,i.e. ,it is a collection agency.Collections' revenues,profits,and stock price tend to rise during recessions.This suggests that Collections Inc.'s beta should be quite high,say 2.0,because it does so much better than most other companies when the economy is weak.

B) Suppose the returns on two stocks are negatively correlated.One has a beta of 1.2 as determined in a regression analysis using data for the last 5 years,while the other has a beta of -0.6.The returns on the stock with the negative beta must have been negatively correlated with returns on most other stocks during that 5-year period.

C) Suppose you are managing a stock portfolio,and you have information that leads you to believe the stock market is likely to be very strong in the immediate future.That is,you are convinced that the market is about to rise sharply.You should sell your high-beta stocks and buy low-beta stocks in order to take advantage of the expected market move.

D) You think that investor sentiment is about to change,and investors are about to become more risk averse.This suggests that you should re-balance your portfolio to include more high-beta stocks.

E) If the market risk premium remains constant,but the risk-free rate declines,then the required returns on low-beta stocks will rise while those on high-beta stocks will decline.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Bad managerial judgments or unforeseen negative events that happen to a firm are defined as "company-specific," or "unsystematic," events,and their effects on investment risk can in theory be diversified away.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Portfolio A has but one security,while Portfolio B has 100 securities.Because of diversification effects,we would expect Portfolio B to have the lower risk.However,it is possible for Portfolio A to be less risky.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Beta is measured by the slope of the security market line.

B) If the risk-free rate rises,then the market risk premium must also rise.

C) If a company's beta is halved,then its required return will also be halved.

D) If a company's beta doubles,then its required return will also double.

E) The slope of the security market line is equal to the market risk premium, (rM - rRF) .

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

"Risk aversion" implies that investors require higher expected returns on riskier than on less risky securities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bill Dukes has $100,000 invested in a 2-stock portfolio.$32,500 is invested in Stock X and the remainder is invested in Stock Y.X's beta is 1.50 and Y's beta is 0.70.What is the portfolio's beta? Do not round your intermediate calculations.Round the final answer to 2 decimal places.

A) 1.06

B) 1.25

C) 0.72

D) 0.96

E) 0.77

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B each have an expected return of 15%,a standard deviation of 20%,and a beta of 1.2.The returns on the two stocks have a correlation coefficient of +0.6.You have a portfolio that consists of 50% A and 50% B.Which of the following statements is CORRECT?

A) The portfolio's beta is less than 1.2.

B) The portfolio's expected return is 15%.

C) The portfolio's standard deviation is greater than 20%.

D) The portfolio's beta is greater than 1.2.

E) The portfolio's standard deviation is 20%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock X has a beta of 0.7 and Stock Y has a beta of 1.3.The standard deviation of each stock's returns is 20%.The stocks' returns are independent of each other,i.e. ,the correlation coefficient,r,between them is zero.Portfolio P consists of 50% X and 50% Y.Given this information,which of the following statements is CORRECT?

A) Portfolio P has a standard deviation of 20%.

B) The required return on Portfolio P is equal to the market risk premium (rM - rRF) .

C) Portfolio P has a beta of 0.7.

D) Portfolio P has a beta of 1.0 and a required return that is equal to the riskless rate,rRF.

E) Portfolio P has the same required return as the market (rM) .

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is the best measure of risk for a single asset held in isolation,and which is the best measure for an asset held in a diversified portfolio?

A) Variance;correlation coefficient.

B) Standard deviation;correlation coefficient.

C) Beta;variance.

D) Coefficient of variation;beta.

E) Beta;beta.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? (Assume that the risk-free rate is a constant. )

A) If the market risk premium increases by 1%,then the required return will increase for stocks that have a beta greater than 1.0,but it will decrease for stocks that have a beta less than 1.0.

B) The effect of a change in the market risk premium depends on the slope of the yield curve.

C) If the market risk premium increases by 1%,then the required return on all stocks will rise by 1%.

D) If the market risk premium increases by 1%,then the required return will increase by 1% for a stock that has a beta of 1.0.

E) The effect of a change in the market risk premium depends on the level of the risk-free rate.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The CAPM is a multi-period model that takes account of differences in securities' maturities,and it can be used to determine the required rate of return for any given level of systematic risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has an expected return of 12%,a beta of 1.2,and a standard deviation of 20%.Stock B also has a beta of 1.2,but its expected return is 10% and its standard deviation is 15%.Portfolio AB has $900,000 invested in Stock A and $300,000 invested in Stock B.The correlation between the two stocks' returns is zero (that is,rA,B = 0) .Which of the following statements is CORRECT?

A) Portfolio AB's standard deviation is 17.5%.

B) The stocks are not in equilibrium based on the CAPM;if A is valued correctly,then B is overvalued.

C) The stocks are not in equilibrium based on the CAPM;if A is valued correctly,then B is undervalued.

D) Portfolio AB's expected return is 11.0%.

E) Portfolio AB's beta is less than 1.2.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that in recent years both expected inflation and the market risk premium (rM - rRF) have declined.Assume also that all stocks have positive betas.Which of the following would be most likely to have occurred as a result of these changes?

A) The required returns on all stocks have fallen,but the decline has been greater for stocks with lower betas.

B) The required returns on all stocks have fallen,but the fall has been greater for stocks with higher betas.

C) The average required return on the market,rM,has remained constant,but the required returns have fallen for stocks that have betas greater than 1.0.

D) Required returns have increased for stocks with betas greater than 1.0 but have declined for stocks with betas less than 1.0.

E) The required returns on all stocks have fallen by the same amount.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kollo Enterprises has a beta of 1.02,the real risk-free rate is 2.00%,investors expect a 3.00% future inflation rate,and the market risk premium is 4.70%.What is Kollo's required rate of return? Do not round your intermediate calculations.

A) 9.11%

B) 12.24%

C) 8.91%

D) 9.40%

E) 9.79%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bae Inc.is considering an investment that has an expected return of 24% and a standard deviation of 10%.What is the investment's coefficient of variation? Do not round your intermediate calculations.Round the final answer to 2 decimal places.

A) 0.42

B) 0.49

C) 0.52

D) 0.50

E) 0.46

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

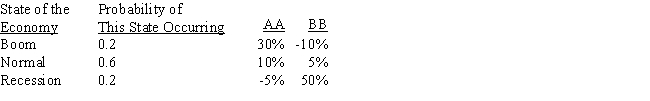

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational,risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

We can conclude from the above information that any rational,risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 147

Related Exams