A) 8.90%

B) 8.70%

C) 10.23%

D) 7.68%

E) 9.72%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Faldo Corp sells on terms that allow customers 45 days to pay for merchandise.Its sales last year were $300,000,and its year-end receivables were $60,000.If its DSO is less than the 45-day credit period,then customers are paying on time.Otherwise,they are paying late.By how much are customers paying early or late? Base your answer on this equation: DSO - Credit Period = Days early or late,and use a 365-day year when calculating the DSO.A positive answer indicates late payments,while a negative answer indicates early payments.Assume all sales to be on credit.Do not round your intermediate calculations.

A) 27.16

B) 26.60

C) 22.12

D) 28.00

E) 25.48

G) A) and B)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

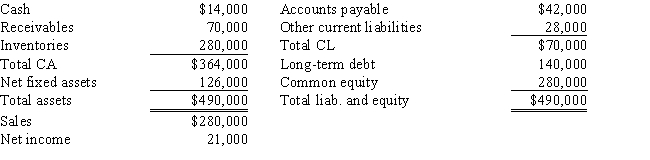

Jordan Inc has the following balance sheet and income statement data:

The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.70,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change? Do not round your intermediate calculations.

The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.70,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change? Do not round your intermediate calculations.

A) 15.25%

B) 13.75%

C) 11.63%

D) 13.50%

E) 12.50%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Other things held constant,the more debt a firm uses,the higher its operating margin will be.

B) Debt management ratios show the extent to which a firm's managers are attempting to magnify returns on owners' capital through the use of financial leverage.

C) Other things held constant,the more debt a firm uses,the higher its profit margin will be.

D) Other things held constant,the higher a firm's total debt to total capital ratio,the higher its TIE ratio will be.

E) Debt management ratios show the extent to which a firm's managers are attempting to reduce risk through the use of financial leverage.The higher the total debt to total capital ratio,the lower the risk.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In general,if investors regard a company as relatively risky and/or having relatively poor growth prospects,then it will have relatively high P/E and M/B ratios.

B) The basic earning power ratio (BEP) reflects the earning power of a firm's assets after giving consideration to financial leverage and tax effects.

C) The "apparent," but not necessarily the "true," financial position of a company whose sales are seasonal can change dramatically during a given year,depending on the time of year when the financial statements are constructed.

D) The market/book (M/B) ratio tells us how much investors are willing to pay for a dollar of accounting book value.In general,investors regard companies with higher M/B ratios as more risky and/or less likely to enjoy higher future growth.

E) It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all the firms being compared have the same proportion of fixed assets to total assets.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

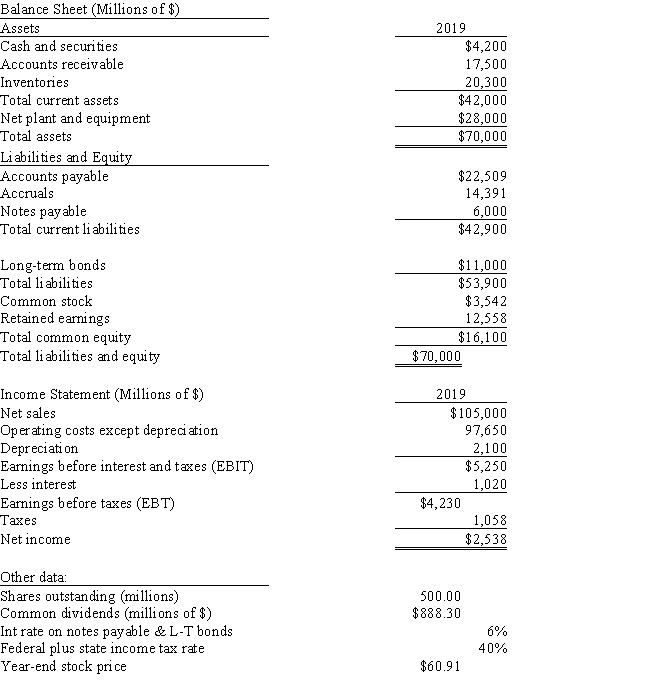

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's days sales outstanding? Assume a 365-day year for this calculation.Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's days sales outstanding? Assume a 365-day year for this calculation.Do not round your intermediate calculations.

A) 56.58

B) 74.83

C) 68.13

D) 69.96

E) 60.83

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose you are analyzing two firms in the same industry.Firm A has a profit margin of 10% versus a margin of 8% for Firm B.Firm A's total debt to total capital ratio [measured as (Short-term debt + Long-term debt)/(Debt + Preferred stock + Common equity)] is 70% versus 20% for Firm B.Based only on these two facts,you cannot reach a conclusion as to which firm is better managed,because the difference in debt,not better management,could be the cause of Firm A's higher profit margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quigley Inc.is considering two financial plans for the coming year.Management expects sales to be $300,000,operating costs to be $265,000,assets (which is equal to its total invested capital) to be $200,000,and its tax rate to be 25%.Under Plan A it would finance the firm using 25% debt and 75% common equity.The interest rate on the debt would be 8.8%,but under a contract with existing bondholders the TIE ratio would have to be maintained at or above 3.9.Under Plan B,the maximum debt that met the TIE constraint would be employed.Assuming that sales,operating costs,assets,total invested capital,the interest rate,and the tax rate would all remain constant,by how much would the ROE change in response to the change in the capital structure? Do not round your intermediate calculations.

A) 5.99%

B) 6.65%

C) 7.85%

D) 7.39%

E) 5.79%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Casey Communications recently issued new common stock and used the proceeds to pay off some of its short-term notes payable.This action had no effect on the company's total assets or operating income.Which of the following effects occurred as a result of this action?

A) The company's current ratio increased.

B) The company's times interest earned ratio decreased.

C) The company's basic earning power ratio increased.

D) The company's equity multiplier increased.

E) The company's total debt to total capital ratio increased.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

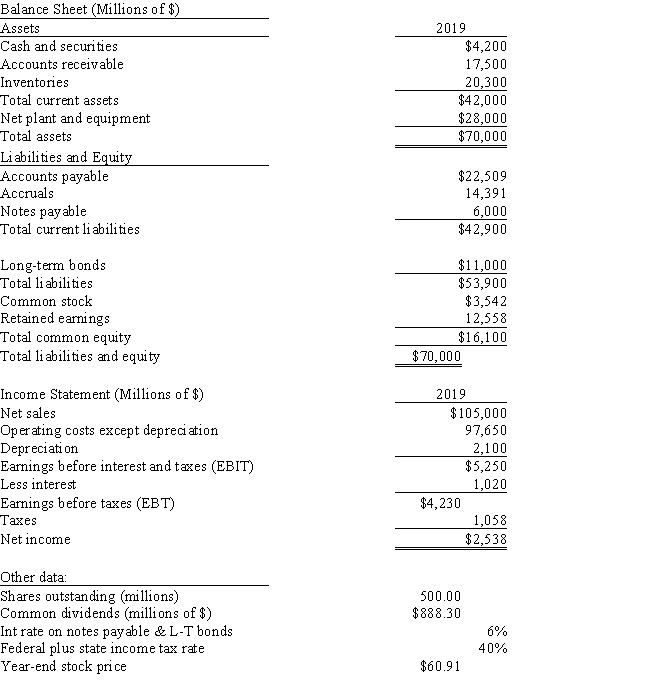

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's ROA? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's ROA? Do not round your intermediate calculations.

A) 3.63%

B) 3.08%

C) 2.83%

D) 4.17%

E) 2.90%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Song Corp's stock price at the end of last year was $28.50 and its earnings per share for the year were $1.30.What was its P/E ratio?

A) 22.58

B) 18.85

C) 21.48

D) 21.92

E) 20.39

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wie Corp's sales last year were $250,000,and its year-end total assets were $355,000.The average firm in the industry has a total assets turnover ratio (TATO) of 2.4.The firm's new CFO believes the firm has excess assets that can be sold so as to bring the TATO down to the industry average without affecting sales.By how much must the assets be reduced to bring the TATO to the industry average,holding sales constant? Do not round your intermediate calculations.

A) $250,833

B) $263,375

C) $268,392

D) $208,192

E) $228,258

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taggart Technologies is considering issuing new common stock and using the proceeds to reduce its outstanding debt.The stock issue would have no effect on total assets,the interest rate Taggart pays,EBIT,or the tax rate.Which of the following is likely to occur if the company goes ahead with the stock issue?

A) The ROA will decline.

B) Taxable income will decline.

C) The tax bill will increase.

D) Net income will decrease.

E) The times-interest-earned ratio will decrease.

G) None of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Last year Rennie Industries had sales of $280,000,assets of $175,000 (which equals total invested capital) ,a profit margin of 5.3%,and an equity multiplier of 1.2.The CFO believes that the company could reduce its assets by $51,000 without affecting either sales or costs.The firm finances using only debt and common equity.Had it reduced its assets by this amount,and had the debt/total invested capital ratio,sales,and costs remained constant,how much would the ROE have changed? Do not round your intermediate calculations.

A) 4.23%

B) 3.26%

C) 3.77%

D) 3.43%

E) 4.19%

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The profit margin measures net income per dollar of sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's fixed assets turnover ratio is significantly higher than the average for its industry,then it could be that the firm uses its fixed assets very efficiently or is operating at over capacity and should probably add fixed assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The return on invested capital (ROIC)differs from the return on assets (ROA).First,ROIC is based on total invested capital rather than total assets.Second,the numerator of the ROIC is after-tax operating income rather than net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

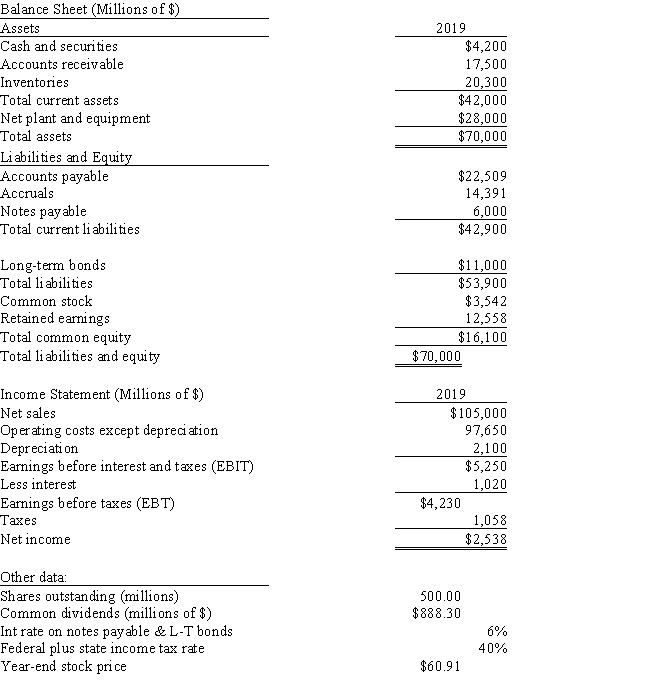

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's total debt to total capital ratio? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's total debt to total capital ratio? Do not round your intermediate calculations.

A) 43.14%

B) 47.76%

C) 58.04%

D) 53.93%

E) 51.36%

G) A) and E)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Considered alone,which of the following would increase a company's current ratio?

A) An increase in net fixed assets.

B) An increase in accrued liabilities.

C) An increase in notes payable.

D) An increase in accounts receivable.

E) An increase in accounts payable.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,a decline in sales accompanied by an increase in financial leverage must result in a lower profit margin.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 133

Related Exams