A) 16.07%

B) 22.87%

C) 15.88%

D) 22.11%

E) 18.90%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the CEO of a large and diversified firm were filling out a fitness report on a division manager (i.e. ,"grading" the manager) ,which of the following situations would be likely to cause the manager to receive a better grade? In all cases,assume that other things are held constant.

A) The division's basic earning power ratio is above the average of other firms in its industry.

B) The division's total assets turnover ratio is below the average for other firms in its industry.

C) The division's total debt to total capital ratio is above the average for other firms in the industry.

D) The division's inventory turnover is 6×,whereas the average for its competitors is 8×.

E) The division's DSO (days' sales outstanding) is 40 days,whereas the average for its competitors is 30 days.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Herring Corporation has operating income of $275,000 and a 25% tax rate.The firm has short-term debt of $143,000,long-term debt of $323,000,and common equity of $466,000.What is its return on invested capital?

A) 20.88%

B) 21.46%

C) 22.13%

D) 23.38%

E) 24.23%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

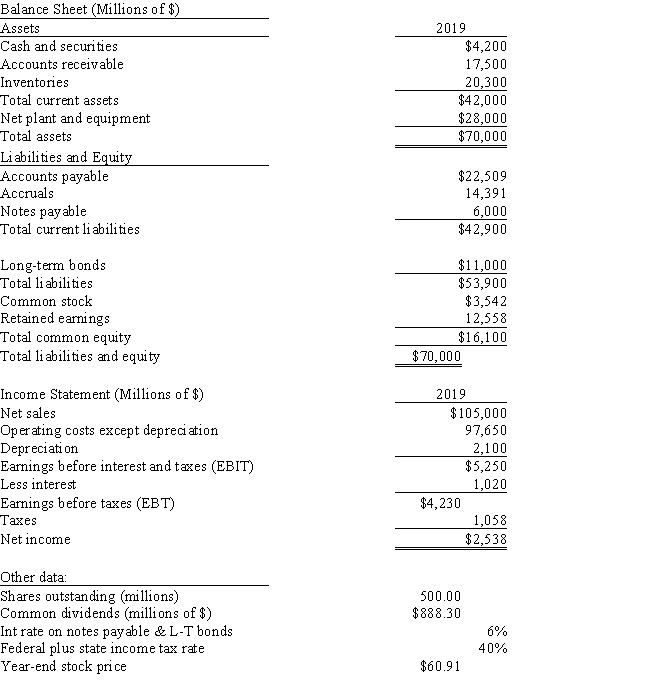

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's profit margin? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's profit margin? Do not round your intermediate calculations.

A) 2.68%

B) 2.37%

C) 2.88%

D) 2.42%

E) 2.30%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Firms A and B have the same current ratio,0.75,the same amount of sales,and the same amount of current liabilities.However,Firm A has a higher inventory turnover ratio than B.Therefore,we can conclude that A's quick ratio must be smaller than B's.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Significant variations in accounting methods among firms make meaningful ratio comparisons between firms more difficult than if all firms used the same or similar accounting methods.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm sold some inventory on credit,its current ratio would probably not change much,but its quick ratio would increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies E and P each reported the same earnings per share (EPS) ,but Company E's stock trades at a higher price.Which of the following statements is CORRECT?

A) Company E probably has fewer growth opportunities.

B) Company E is probably judged by investors to be riskier.

C) Company E must have a higher market-to-book ratio.

D) Company E must pay a lower dividend.

E) Company E trades at a higher P/E ratio.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Since the ROA measures the firm's effective utilization of assets without considering how these assets are financed,two firms with the same EBIT must have the same ROA.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,the more debt a firm uses,the lower the firm's operating margin will be.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The market/book (M/B)ratio tells us how much investors are willing to pay for a dollar of accounting book value.In general,investors regard companies with higher M/B ratios as less risky and/or more likely to enjoy higher growth in the future.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The basic earning power ratio (BEP)reflects the earning power of a firm's assets after giving consideration to financial leverage and tax effects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Even though Firm A's current ratio exceeds that of Firm B,Firm B's quick ratio might exceed that of A.However,if A's quick ratio exceeds B's,then we can be certain that A's current ratio is also larger than B's.

B) Suppose a firm wants to maintain a specific TIE ratio.It knows the amount of its debt,the interest rate on that debt,the applicable tax rate,and its operating costs.With this information,the firm can calculate the amount of sales required to achieve its target TIE ratio.

C) Since the ROA measures the firm's effective utilization of assets without considering how these assets are financed,two firms with the same EBIT must have the same ROA.

D) Suppose all firms follow similar financing policies,face similar risks,have equal access to capital,and operate in competitive product and capital markets.However,firms face different operating conditions because,for example,the grocery store industry is different from the airline industry.Under these conditions,firms with high profit margins will tend to have high asset turnover ratios,and firms with low profit margins will tend to have low turnover ratios.

E) Klein Cosmetics has a profit margin of 5.0%,a total assets turnover ratio of 1.5 times,no debt and therefore an equity multiplier of 1.0,and an ROE of 7.5%.The CFO recommends that the firm borrow funds using long-term debt,use the funds to buy back stock,and raise the equity multiplier to 2.0.The size of the firm (assets) would not change.She thinks that operations would not be affected,but interest on the new debt would lower the profit margin to 4.5%.This would probably not be a good move,as it would decrease the ROE from 7.5% to 6.5%.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position.Which of the following actions would increase its current ratio?

A) Reduce the company's days' sales outstanding to the industry average and use the resulting cash savings to purchase a new plant and equipment.

B) Use cash to repurchase some of the company's own stock.

C) Borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than one year.

D) Issue new stock,then use some of the proceeds to purchase additional inventory and hold the remainder as cash.

E) Use cash to increase inventory holdings.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your sister is thinking about starting a new business.The company would require $355,000 of assets,and it would be financed entirely with common stock.She will go forward only if she thinks the firm can provide a 13.5% return on the invested capital,which means that the firm must have an ROE of 13.5%.How much net income must be expected to warrant starting the business?

A) $44,091

B) $53,676

C) $45,529

D) $47,925

E) $51,759

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Determining whether a firm's financial position is improving or deteriorating requires analyzing more than the ratios for a given year.Trend analysis is one method of examining changes in a firm's performance over time.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,the more debt a firm uses,the lower the firm's profit margin will be.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A decline in a firm's inventory turnover ratio suggests that it is improving both its inventory management and its liquidity position,i.e. ,that it is becoming more liquid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ryngard Corp's sales last year were $24,000,and its total assets were $16,000.What was its total assets turnover ratio (TATO) ?

A) 1.73

B) 1.56

C) 1.53

D) 1.79

E) 1.50

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Klein Cosmetics has a profit margin of 5.0%,a total assets turnover ratio of 1.5 times,no debt and therefore an equity multiplier of 1.0,and an ROE of 7.5%.The CFO recommends that the firm borrow money,use the funds to buy back stock,and raise the equity multiplier to 2.0.The size of the firm (assets)would not change.She thinks that operations would not be affected,but interest on the new debt would lower the profit margin to 4.5%.This would probably be a good move,as it would increase the ROE from 7.5% to 13.5%.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 133

Related Exams