A) $1159

B) $1,131

C) $884

D) $1,150

E) $950

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shrives Publishing recently reported $11,500 of sales,$5,500 of operating costs other than depreciation,and $1,250 of depreciation.The company had $3,500 of bonds that carry a 6.25% interest rate,and its federal-plus-state income tax rate was 25%.During the year,the firm had expenditures on fixed assets and net operating working capital that totaled $1,550.These expenditures were necessary for it to sustain operations and generate future sales and cash flows.What was its free cash flow? (Round your intermediate and final answers to whole dollar amount. )

A) $3,457

B) $2,593

C) $2,955

D) $3,263

E) $3,039

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since depreciation increases the firm's net cash provided by operating activities,the more depreciation a company has,the larger its retained earnings will be,other things held constant.

B) A firm can show a large amount of retained earnings on its balance sheet yet need to borrow cash to make required payments.

C) Common equity includes common stock and retained earnings,less accumulated depreciation.

D) The retained earnings account as reported on the balance sheet shows the amount of cash that is available for paying dividends.

E) If a firm reports a loss on its income statement,then the retained earnings account as shown on the balance sheet will be negative.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items cannot be found on a firm's balance sheet under current liabilities?

A) Accounts payable.

B) Short-term notes payable to the bank.

C) Accrued wages.

D) Cost of goods sold.

E) Accrued payroll taxes.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

EBITDA stands for "earnings before interest,taxes,debt,and assets."

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For 2019,Bargain Basement Stores reported $11,500 of sales and $5,000 of operating costs (including depreciation) .The company has $20,500 of total invested capital,the weighted average cost of that capital (the WACC) was 11%,and the federal-plus-state income tax rate was 25%.What was the firm's Economic Value Added (EVA) ,i.e. ,how much value did management add to stockholders' wealth during 2019?

A) $1,727

B) $1,398

C) $3,256

D) $2,101

E) $2,620

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The next-to-last line on the income statement shows the firm's earnings,while the last line shows the dividends the company paid.Therefore,the dividends are frequently called "the bottom line."

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

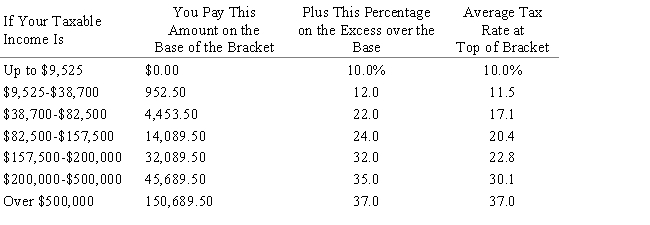

Maureen Smith is a single individual.She claims a standard deduction of $12,000.Her salary for the year was $213,650.Assume the following tax table is applicable. Single Individuals

What is her average tax rate?

A) 24.34%

B) 19.18%

C) 22.94%

D) 24.58%

E) 27.29%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Analysts who follow Howe Industries recently noted that,relative to the previous year,the company's net cash provided from operations increased,yet cash as reported on the balance sheet decreased.Which of the following factors could explain this situation?

A) The company cut its dividend.

B) The company made large investments in fixed assets.

C) The company sold a division and received cash in return.

D) The company issued new common stock.

E) The company issued new long-term debt.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Casey Motors recently reported the following information: ∙ Net income = $475,000. ∙ Tax rate = 25%. ∙ Interest expense = $200,000. ∙ Total invested capital employed = $9 million. ∙ After-tax cost of capital = 10%. What is the company's EVA?

A) -$277,750

B) -$209,000

C) -$291,500

D) -$275,000

E) -$305,250

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Congress recently passed a provision that will enable Bev's Beverages Inc.(BBI) to double its depreciation expense for the upcoming year but will have no effect on its sales revenue or the tax rate.Prior to the new provision,BBI's net income was forecasted to be $4 million.Which of the following best describes the impact of the new provision on BBI's financial statements versus the statements without the provision? Assume that the company uses the same depreciation method for tax and stockholder reporting purposes.

A) The provision will reduce the company's cash flow.

B) The provision will increase the company's tax payments.

C) The provision will increase the firm's operating income (EBIT) .

D) The provision will increase the company's net income.

E) Net fixed assets on the balance sheet will decrease.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate bond currently yields 8.80%.Municipal bonds with the same risk,maturity,and liquidity currently yield 5.50%.At what tax rate would investors be indifferent between the two bonds? (Round your final answer to two decimal places. )

A) 45.00%

B) 33.75%

C) 37.50%

D) 42.00%

E) 28.50%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The balance sheet represents a snapshot in time,whereas the income statement reports on operations over a period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2018,Uniontown Books had EBIT equal to -$1,200,000.In 2019,its EBIT was $1,800,000. The company has no debt,and therefore,pays no interest expense.Its corporate tax rate is 25%.What was Uniontown's tax liability for 2019? (Assume that the company takes full advantage of the carry-forward provision.

A) $75,000

B) $950,000

C) $300,000

D) $150,000

E) $225,000

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

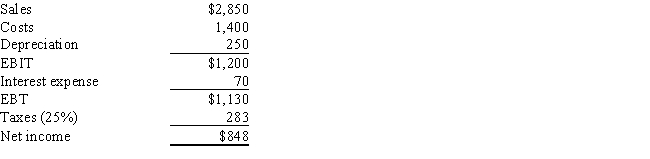

Kwok Enterprises has the following income statement.How much after-tax operating income does the firm have?

A) $720

B) $742

C) $684

D) $619

E) $626

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Its retained earnings is the actual cash that the firm has generated through operations less the cash that has been paid out to stockholders as dividends.If the firm has sufficient retained earnings,it can purchase assets and pay for them with cash from retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

West Corporation has $50,000 that it plans to invest in marketable securities.The corporation is choosing between the following three equally risky securities: Alachua County tax-free municipal bonds yielding 8.50%;Exxon Mobil bonds yielding 10.50%;and GM preferred stock with a dividend yield of 9.80%.West's corporate tax rate is 25.00%.What is the after-tax return on the best investment alternative? Assume a 70.00% dividend exclusion for tax on dividends.(Assume the company chooses on the basis of after-tax returns.Round your final answer to 3 decimal places. )

A) 7.252%

B) 8.159%

C) 7.705%

D) 8.575%

E) 8.249%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A loss incurred by a corporation

A) must be carried back 2 years before being carried forward for 5 years.

B) can be carried forward indefintely.

C) can be carried back 5 years and forward 3 years.

D) cannot be used to reduce taxes in other years except with special permission from the IRS.

E) can be carried back 3 years or forward 10 years,whichever is more advantageous to the firm.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the years,O'Brien Corporation's stockholders have provided $20,000,000 of capital,when they purchased new issues of stock and allowed management to retain some of the firm's earnings.The firm now has 1,000,000 shares of common stock outstanding,and it sells at a price of $41.00 per share.How much value has O'Brien's management added to stockholder wealth over the years,i.e. ,what is O'Brien's MVA?

A) $23,100,000

B) $19,950,000

C) $22,050,000

D) $24,150,000

E) $21,000,000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hayes Corporation has $300 million of common equity,with 6 million shares of common stock outstanding.If Hayes' Market Value Added (MVA) is $126 million,what is the company's stock price? (Round your final answer to two decimal places. )

A) $71.00

B) $65.32

C) $66.74

D) $60.35

E) $80.23

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 138

Related Exams