B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rao Construction recently reported $30.00 million of sales,$12.60 million of operating costs other than depreciation,and $3.00 million of depreciation.It had $8.50 million of bonds outstanding that carry a 7.0% interest rate,and its federal-plus-state income tax rate was 25%.What was Rao's operating income,or EBIT,in millions?

A) $11.09

B) $16.70

C) $14.54

D) $14.40

E) $16.56

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

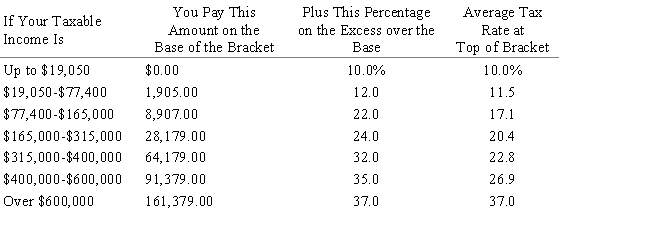

Alan and Sara Winthrop are a married couple who file a joint income tax return.They have two children,and they have legitimate itemized deductions totaling $25,750.Their total income from wages is $251,400.Assume the following tax table is applicable: Married Couples Filing Joint Returns

What is their marginal tax rate?

A) 32.0%

B) 35.0%

C) 10.0%

D) 24.0%

E) 12.0%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Assume that two firms are both following generally accepted accounting principles.Both firms commenced operations two years ago with $1 million of identical fixed assets,and neither firm either sold any of those assets or purchased any new fixed assets.The two firms would be required to report the same amount of net fixed assets on their balance sheets as those statements are presented to investors.

B) Assets other than cash are expected to produce cash over time,and the amount of cash they eventually produce must be the same as the amounts at which the assets are carried on the books.

C) The income statement shows the difference between a firm's income and its costs-i.e. ,its profits-during a specified period of time.However,all reported income comes in the form of cash,and reported costs likewise are consistent with cash outlays.Therefore,there will not be a substantial difference between a firm's reported profits and its actual cash flow for the same period.

D) The primary reason the annual report is important in finance is that it is used by investors when they form expectations about the firm's future earnings and dividends and the riskiness of those cash flows.

E) EPS stands for "earnings per share," while DPS stands for "dividends per share." We would normally expect to see DPS exceed EPS.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Free cash flow is the amount of cash that,if withdrawn,would harm the firm's ability to operate and to produce future cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For managerial purposes,i.e. ,making decisions regarding the firm's operations,the standard financial statements as prepared by accountants under generally accepted accounting principles (GAAP) are often modified and used to create alternative data and metrics that provide a somewhat different picture of a firm's operations.Related to these modifications,which of the following statements is CORRECT?

A) The standard statements make adjustments to reflect the effects of inflation on asset values,and these adjustments are normally carried into any adjustment that managers make to the standard statements.

B) The standard statements focus on accounting income for the entire corporation,not cash flows,and the two can be quite different during any given accounting period.However,the firm's value is based on its future cash flows because future cash flows indicate how much the firm can distribute to its investors.

C) The standard statements provide useful information on the firm's individual operating units,but management needs more information on the firm's overall operations than the standard statements provide.

D) The standard statements focus on cash flows,but managers should be less concerned with cash flows than with accounting income as defined by GAAP.

E) The best feature of standard statements is that,if they are prepared under GAAP,the data are always consistent from firm to firm.Thus,under GAAP,there is no room for accountants to "adjust" the results to make earnings look better.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Companies typically provide four basic financial statements: the fixed income statement,the current income statement,the balance sheet,and the cash flow statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year,Delip Industries had (1) negative cash flow from operations, (2) a negative free cash flow,and (3) an increase in cash as reported on its balance sheet.Which of the following factors could explain this situation?

A) The company had a sharp increase in its inventories.

B) The company had a sharp increase in its accrued liabilities.

C) The company sold a new issue of common stock.

D) The company made a large capital investment early in the year.

E) The company had a sharp increase in depreciation expenses.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The more depreciation a firm reports,the higher its tax bill,other things held constant.

B) Because a firm's cash flow is shown as the lowest entry on the income statement,people often call it "the bottom line."

C) Depreciation reduces a firm's cash balance,so an increase in depreciation would normally lead to a reduction in the firm's cash flow.

D) Operating income is derived from the firm's regular core business.Operating income is calculated as Revenues less Operating costs.Operating costs do not include interest or taxes.

E) Depreciation is not a cash charge,so it does not have an effect on a firm's reported profits.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

.In 2018,Mays Industries taxable income was -$85,000.In 2019,its taxable income was $120,000. Its corporate tax rate is 25%.Assume that the company takes full advantage of the Tax Code's carry-forward provision.What is the company's tax liability for 2019?

A) $14,400

B) $10,500

C) $8,750

D) $12,480

E) $13,650

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bauer Software's current balance sheet shows total common equity of $5,125,000.The company has 300,000 shares of stock outstanding,and they sell at a price of $27.50 per share.By how much do the firm's market and book values per share differ? (Round your intermediate and final answer to two decimal places. )

A) $13.02

B) $12.71

C) $12.92

D) $10.42

E) $9.38

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Almazan Software reported $10.500 million of sales,$6.250 million of operating costs other than depreciation,and $1.300 million of depreciation.The company had $5.000 million of bonds that carry a 6.5% interest rate,and its federal-plus-state income tax rate was 25%.This year's data are expected to remain unchanged except for one item,depreciation,which is expected to increase by $.670 million.By how much will net income change as a result of the change in depreciation? The company uses the same depreciation calculations for tax and stockholder reporting purposes.(Round your final answer to 3 decimal places. )

A) -$0.388

B) -$0.444

C) -$0.479

D) -$0.436

E) -$0.503

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 7-year municipal bond yields 4.80%.Your marginal tax rate (including state and federal taxes) is 32.00%.What interest rate on a 7-year corporate bond of equal risk would provide you with the same after-tax return? (Round your final answer to two decimal places. )

A) 8.68%

B) 8.19%

C) 6.00%

D) 6.28%

E) 7.06%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company Z has $90,000 of taxable income from its operations,$5,000 of interest income,and $30,000 of dividend income from preferred stock it holds in other corporations.Its corporate tax rate is 25%.What is Company Z's tax liability? Assume a 50% dividend exclusion for tax on dividends.

A) $27,500

B) $51,300

C) $25,000

D) $5,100

E) $60,100

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vasudevan Inc.recently reported operating income of $2.3 million,depreciation of $1.20 million,and had a tax rate of 25%.The firm's expenditures on fixed assets and net operating working capital totaled $0.60 million.How much was its free cash flow,in millions?

A) $2.22

B) $2.06

C) $2.325

D) $2.44

E) $1.96

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Two metrics that are used to measure a company's financial performance are net income and cash flow.Accountants emphasize net income as calculated in accordance with generally accepted accounting principles.Finance people generally put at least as much weight on cash flows as they do on net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year,Martyn Company had $340,000 in taxable income from its operations,$50,000 in interest income,and $100,000 in dividend income.Its corporate tax rate is 25%.What was the company's tax liability for the year? Assume a 50% dividend exclusion for tax on dividends

A) $110,000

B) $150,100

C) $125,000

D) $108,522

E) $162,792

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Assets other than cash are expected to produce cash over time,and the amounts of cash they eventually produce should be exactly the same as the amounts at which the assets are carried on the books.

B) The primary reason the annual report is important in finance is that it is used by investors when they form expectations about the firm's future earnings and dividends and the riskiness of those cash flows.

C) The annual report is an internal document prepared by a firm's managers solely for the use of its creditors/lenders.

D) The four most important financial statements provided in the annual report are the balance sheet,income statement,cash budget,and the statement of stockholders' equity.

E) Prior to the Enron scandal in the early 2000s,companies would put verbal information in their annual reports along with the financial statements.That verbal information was often misleading,so today annual reports can contain only quantitative information-audited financial statements.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carter Corporation has some money to invest,and its treasurer is choosing between City of Chicago municipal bonds and U.S.Treasury bonds.Both have the same maturity,and they are equally risky and liquid.If Treasury bonds yield 6.00%,and Carter's marginal income tax rate is 25.00%,what yield on the Chicago municipal bonds would make Carter's treasurer indifferent between the two?

A) 3.56%

B) 3.69%

C) 4.50%

D) 5.45%

E) 4.55%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An increase in accounts receivable is added to net income in the operating activities section because if accounts receivable increase,then when they are collected cash will come into the firm.

B) In finance,we are generally more interested in cash flows than in accounting profits.Free cash flow (FCF) is calculated as after-tax operating income plus depreciation less the sum of capital expenditures and the change in net operating working capital.Free cash flow is the amount of cash that could be withdrawn without harming the firm's ability to operate and to produce future cash flows.

C) The first major section of a typical statement of cash flows is "Operating Activities," and the first entry in this section is "Net Income." Then,also in the first section,we show some items that add to or subtract from cash,and the last entry is called "Net Cash Provided by Operating Activities." This number can be either positive or negative,but if it is negative,the firm is almost certain to soon go bankrupt.

D) The next-to-last line on the income statement shows the firm's earnings,while the last line shows the dividends the company paid.Therefore,the dividends are frequently called "the bottom line."

E) Most rapidly growing companies have positive free cash flows because cash flows from existing operations will exceed fixed assets and working capital needed to support the growth.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 138

Related Exams